What is impermanent loss in Cryptocurrency?

Tue Jul 04 2023

In this article we're exploring the concept of impermanent loss in cryptocurrency trading and how to prevent it. Read more.

Cryptocurrencies are known for their volatile nature, and the decentralized finance (DeFi) industry is no exception. Many DeFi protocols, such as Uniswap, SushiSwap, or PancakeSwap, allow anyone to become a market maker and earn commissions by placing their assets in a common pool of liquidity. However, this approach to asset allocation comes with a risk of impermanent loss, which is a temporary loss of funds faced by liquidity providers from decentralized platforms.

What is Impermanent Loss?

Impermanent loss occurs when the value of crypto assets on decentralized (DEX) and centralized marketplaces (CEX) is different. For example, on UniSwap, the price of BTC can be $30,000, and on Binance, $32,000. When liquidity providers provide liquidity to the liquidity pool, they are exposed to an impermanent loss, which means less value in dollars at the time of withdrawal than at the time of deposit.

How to Prevent Impermanent Loss?

One of the easiest and most effective ways to mitigate intermittent losses is maintaining liquidity in pairs with low volatility. Above all, preference should be given to older and more significant projects that already have their price formed and are less volatile. These include cryptocurrencies from the Top 20 by capitalization. However, note that a project’s size by market cap is not necessarily indicative of its success or stability, so make sure to do your own research into any assets that you are planning to stake on DEXes.

Second, you have to choose pairs where the value of one asset relative to another remains relatively stable. For example, it can be paired with stablecoins. However, this kind of investment option is limited in terms of potential price growth.

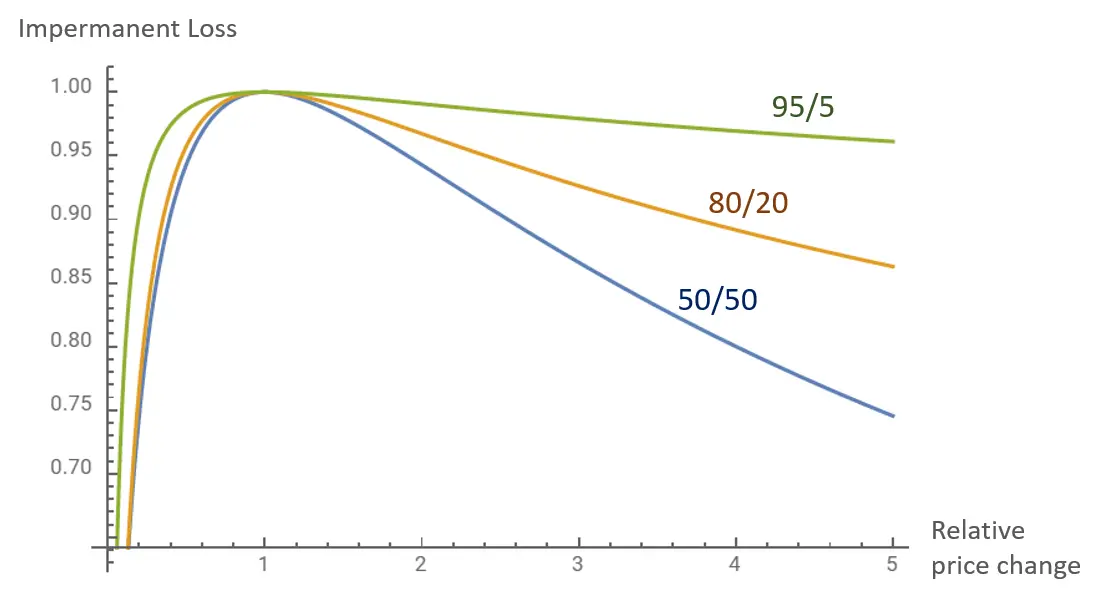

Some special tools and platforms allow liquidity providers to mitigate volatile losses. For example, the AMM Balancer protocol allows customization of individual proportions for liquidity pools with different pairs. In this way, liquidity providers can anticipate market movements and reduce their potential volatile losses if asset values move as they have planned.

It’s best to start investing in AMM in small amounts. Especially if you are just getting familiar with the market or trading pair, small investments help to evaluate with minimum risk which way the price can move and what real losses can be incurred.

Conclusion

Impermanent Loss is one of the main terms that liquidity providers should be familiar with. Many of the most popular AMMs, such as Uniswap, PancakeSwap, and others, have emphasized usability and simplicity without providing any mechanism to prevent liquidity pool impermanent loss. Therefore, investors should understand what LPs are, how losses are generated and avoid potential losses. By using a reliable algorithmic cryptocurrency trading platform, traders can mitigate the risks of impermanent loss and make smart investment decisions.