A Guide to Cryptocurrency Market Cap

Wed Jul 26 2023

In algorithmic cryptocurrency trading, understanding market cap is essential for making informed investment decisions. While market cap is a valuable metric, it should not be the sole basis for investment decisions.

In the world of algorithmic cryptocurrency trading, understanding market cap and its significance is crucial for making informed investment decisions. Market capitalization (market cap) is a metric that calculates the value of an asset, such as a cryptocurrency, based on current exchange quotations.

The Importance of Market Cap in Cryptocurrency Trading

Market cap plays a pivotal role in evaluating and categorizing cryptocurrencies. It represents the total value of a cryptocurrency and indicates its relative size within the market. Market cap is directly influenced by the price, volume, and liquidity of a cryptocurrency. It is important to differentiate market cap from trading volume, as the latter reflects the overall activity of the market rather than assessing its value. Moreover, market cap does not provide information on the amount of money in the market.

Calculating Market Cap

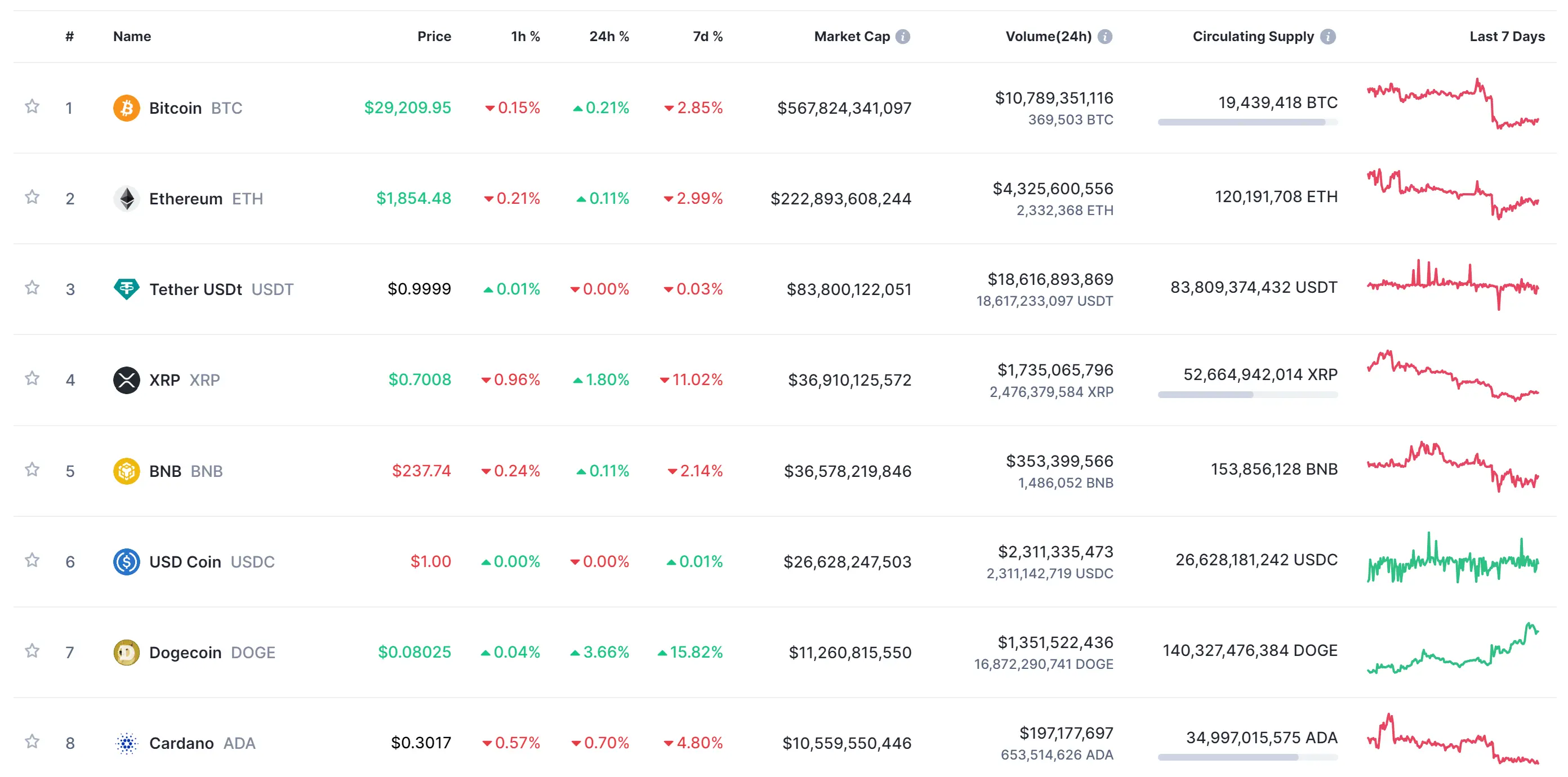

To calculate market cap, you multiply the current price of a cryptocurrency by its circulating supply. For example, if a cryptocurrency has a circulating supply of 1 million coins and the price per coin is $100, the market capitalization would be $100 million. Another approach, known as fully diluted supply (FDV), considers all coins rather than just the circulating ones.

Utilizing Market Cap in Algorithmic Cryptocurrency Trading

Understanding how to utilize market cap to your advantage is crucial in algorithmic cryptocurrency trading. The size of a cryptocurrency’s market cap is essential in categorizing and assessing its growth potential. While new projects with small market caps may seem appealing due to their features and innovations, it is important to factor in market cap data along with other metrics. The main factors that influence market cap are the price and circulating supply of the tokens.

Categorizing Market Caps and Risk Assessment

Categorizing cryptocurrencies based on their market caps is an important step in formulating a wise investment strategy. Large market cap projects are less likely to experience drastic drops even if a significant number of investors withdraw their assets. However, they can still be volatile. Medium market cap projects carry more risk but also offer higher potential rewards, especially for early investors. It is crucial to consider market cap data in addition to other factors when assessing the growth potential of a cryptocurrency.

Differences Between Traditional and Crypto Investing

While market capitalization is relevant to both traditional stock markets and cryptocurrencies, there are key differences to consider. Weighted market capitalization, a popular method for creating investment portfolios in traditional stocks, may not work as effectively in the cryptocurrency market. The cryptocurrency market can be inefficient, and relying solely on market cap indicators may result in missing out on promising startups in their early stages. Additionally, the dominance of Bitcoin can skew portfolios that are built solely based on market cap indicators.

Market Cap as an Investment Tool

While market cap is a valuable metric for identifying desirable digital assets, it should not be the sole basis for investment decisions. Factors such as public enthusiasm, circulating supply, and other market dynamics can significantly impact the potential of a cryptocurrency. Advanced algorithmic traders use market cap to compare the true value of cryptocurrencies and determine their future development. Generally, higher market cap indicates more appeal to investors.

The Significance of Bitcoin’s Market Cap

Bitcoin, the most well-known cryptocurrency, continues to dominate the market in terms of market capitalization. With a fully diluted supply of only 21 million coins, Bitcoin’s scarcity and utility contribute to its success within the blockchain industry. Understanding market cap is crucial for gaining a broader understanding of any token, coin, or project.

The best way to learn is by doing so sign up on AESIR to build, test and deploy your crypto trading bots.