What is a Market Order?

Wed May 17 2023

Understanding the different order types is crucial for every trader, whether trading manually or algorithmically by using a crypto trading bot platform. Read more.

Trading in a dynamic financial marketplace, including cryptocurrencies, stocks, or forex, involves many complexities beyond mere buying and selling. Knowledge of diverse order types is vital for traders. One of the most basic yet crucial types is the market order. This article elaborates on the concept of market orders, their operation, and appropriate usage scenarios. Whether you’re trading manually, or using a crypto trading bot platform such as Æsir, order types are vital to understand.

What is a market order?

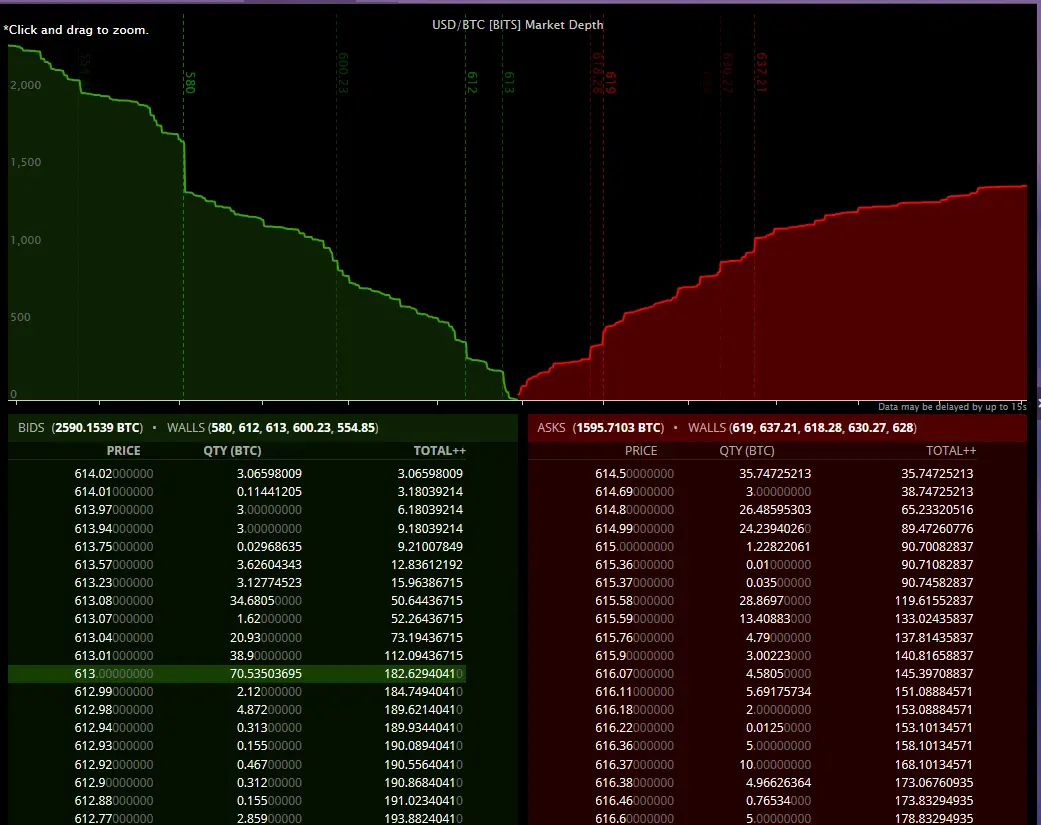

A market order is a directive to either purchase or dispose of an asset at the finest price currently available in the market. These orders are promptly executed, relying on the limit orders previously set on the order book. To satisfy this immediate demand, the exchange must have adequate liquidity on the order book. It’s important to note that placing a market order extracts liquidity from the exchange, resulting in higher fees due to your role as a market taker.

How does a market order work?

In contrast to limit orders, which are reserved on the order book, market orders are fulfilled instantly at the prevailing market price. Every trade is a dance involving two partners: the maker and the taker. The act of placing a market order makes you the taker, accepting the price determined by another trader. For instance, an exchange would couple a purchase market order with the lowest ask price on the order book. Conversely, a sell market order would be paired with the highest bid price listed on the order book.

Market Order vs. Limit Order: The Trade-off

Limit orders signify a directive to buy or sell a specified amount of a financial asset at a predetermined price or better. You have the flexibility to dictate whether your limit order can be partially filled or if it necessitates complete filling. If the latter and the exchange is unable to fulfill your order in its entirety, the order won’t be executed at all.

Market orders can only be completed with pre-existing limit orders. Many traders and investors may not wish to accept the readily available market price, making limit orders a more attractive alternative in such scenarios.

Deciding When to Use a Market Order?

Market orders are advantageous when ensuring the execution of your order outweighs the need for a specific price. Thus, it’s advisable to use market orders only if you consent to the potential higher cost incurred from the slippage. In essence, market orders are a useful tool if you’re pressed for time.

There may be instances where your stop-limit order is overlooked, necessitating an immediate buy/sell action. Market orders prove to be a lifesaver in such circumstances, enabling you to swiftly enter or exit a trade. However, if you are a seasoned crypto trader intending to acquire altcoins with Bitcoin, steer clear of market orders as you may end up paying more than required. In such situations, limit orders are likely the superior choice.

Benefits of using a Market Order

Market orders can be a powerful tool in a trader’s arsenal under the right circumstances. Here are the key advantages:

- Market orders are straightforward and user-friendly. If your trading strategy involves highly liquid assets such as Bitcoin or ETH, which have substantial market capitalization, then deploying a market order is a relatively safe bet.

- Market orders allow you to buy or sell the exact quantity of an asset you desire. If you’re in a situation where you need to swiftly open or close your positions, a market order is your best bet to ensure execution.

- Market orders facilitate instant trading. If you’re under time constraints to execute a trade, such as right before market closure, you can be confident that a market order will be the fastest method to achieve this.

The Downsides of using a Market Order

While the main strength of a market order lies in its speed, it does compromise control. Here are the main caveats:

- With low-volume assets, you may encounter high slippage. This could lead to you paying more than you intended or receiving less than expected. In situations with insufficient volume on the order book, you might end up moving up or down through the placed orders.

- Market orders don’t allow for pre-planned trades. If you’re unable to monitor the market constantly, like when you’re asleep or otherwise engaged, you won’t be able to place a market order. In such cases, utilizing a limit or stop-limit order to plan ahead could be a smarter strategy.

Wrapping Up

Market orders provide the simplest avenue for buying or selling financial assets at the best available price. They prove invaluable when quick entry or exit from a trade is a priority. However, they do come with their share of risks, such as slippage and limited control. Hence, it’s crucial to comprehend the specifics of your trading situation and determine the most suitable order type, be it a market order or an alternative. Whether you’re a beginner or an experienced trader, using a platform like Æsir can help streamline the process, making it easier to manage these various aspects of trading.

The best way to learn is by doing, go ahead and create a free account on Æsir, and learn the ins and outs of the market using our Paper Trading feature, that allows you to run strategies with virtual currency, so there’s no risk involved.