How to manage, grow and diversify your cryptocurrency portfolio

Mon Jul 10 2023

Managing and creating your portfolio takes time and requires significant research into the assets that you choose to be part of your portfolio. Here are some tips and guides to help you build or expand your cryptocurrency portfolio.

Algorithmic cryptocurrency trading has gained significant popularity in recent years. Investors and traders are leveraging automated trading systems and cryptocurrency trading bots to maximize returns and reduce risks. One great aspect of algorithmic trading is that it can help you automatically manage your portfolio. In this article we’ll go over the concept of portfolio management, focusing on how to build and diversify your portfolio.

What is Portfolio Management

Portfolio management involves the selection and oversight of a basket of different investments to achieve long-term financial goals while considering the investor’s risk profile. There are two types of portfolio management ideologies: active and passive. Active portfolio managers attempt to “beat the market,” while passive ones invest alongside the market to “match” it.

Portfolio management is generally based on the Modern Portfolio Theory (MPT), developed by Harry Markowitz in the 1950s. MPT gives mathematical form to the basic intuition behind diversification, which is that it is safer to invest in a range of different assets or asset classes than in just one. In cryptocurrency trading, investors need to compose a portfolio of different assets in such a way that their returns will be maximized without increasing their level of risk.

In other words, portfolio Management ensures that you’re not putting all of your eggs in one basket.

Building an Investment Portfolio

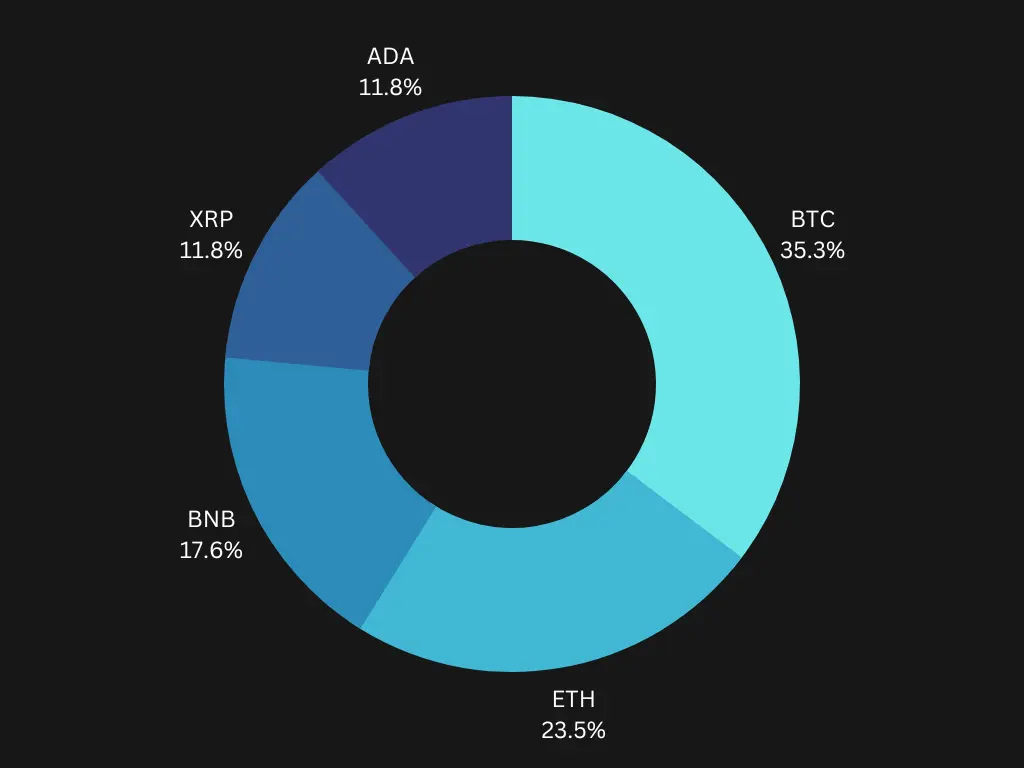

Building an investment portfolio involves determining the asset classes to compose a portfolio from, spreading the asset-specific risks by investing in a range of different asset classes, industries, or regions, and periodic assessment of the portfolio’s performance and alignment with the initial financial goals. While there is no consensus on the number of cryptocurrencies that should be in one’s portfolio, it’s best to consider several different assets as part of your portfolio.

Investors need to consider several factors when choosing cryptocurrencies for their portfolio, including the market capitalization, trading volume, market trends, and volatility. They must also evaluate the project’s whitepaper, the team behind the project, and the partnerships it has formed. Once you’re happy with the results of your research, you can use an algorithmic cryptocurrency trading platform like Aesir to automatically DCA for you at a specific interval.

Another consideration to bear in mind, is the risk of spreading your portfolio too thin, or investing in similar asset types, thus not diversifying enough. Investing in similar assets can be quite tricky to determine, especially if’we talking cryptocurrency only, but you could in theory invest in coins that continue to devalue in time, resulting in a week portfolio. Projects with a small market cap and little to no utility are more likely to never really pick up in popularity and might even be a part of a pump and dump scheme, so through research in required.

The best way to manage and build your portfolio is by using an algorithmic cryptocurrency trading platform like Aesir. A tool like this will allow you to perform actions like DCA or buy the dip at a specific time, or market threshold, ensuring that you are growing and managing your portfolio consistently. Best of all, if you’re taking profit Aesir can re-invest the profit made, back into the assets you’re managing, leading to more growth. Get started here.