Navigating Buy and Sell Walls in Algorithmic Cryptocurrency Trading

Fri Jul 14 2023

Buy and Sell walls often can sometimes lead to a shift in market momentum, and thus are considered a good indicator for swing traders. Here's how to manage Buy and Sell Walls with your cryptocurrency trading bot.

Understanding the concept of buy and sell walls is essential for traders venturing into the algorithmic cryptocurrency market. They act as psychological barriers that affect market participants’ decisions. While these walls can be real indicators of market sentiment, they can also be manipulative tools deployed by large-scale traders, often referred to as ‘whales’. Thus, proper navigation of these walls becomes crucial. An advanced trading platform like AESIR Crypto offers tools like cryptocurrency trading bots and robust risk management features that can assist traders in this endeavor.

Buy and Sell Walls: Market Sentiments and Whale Movements

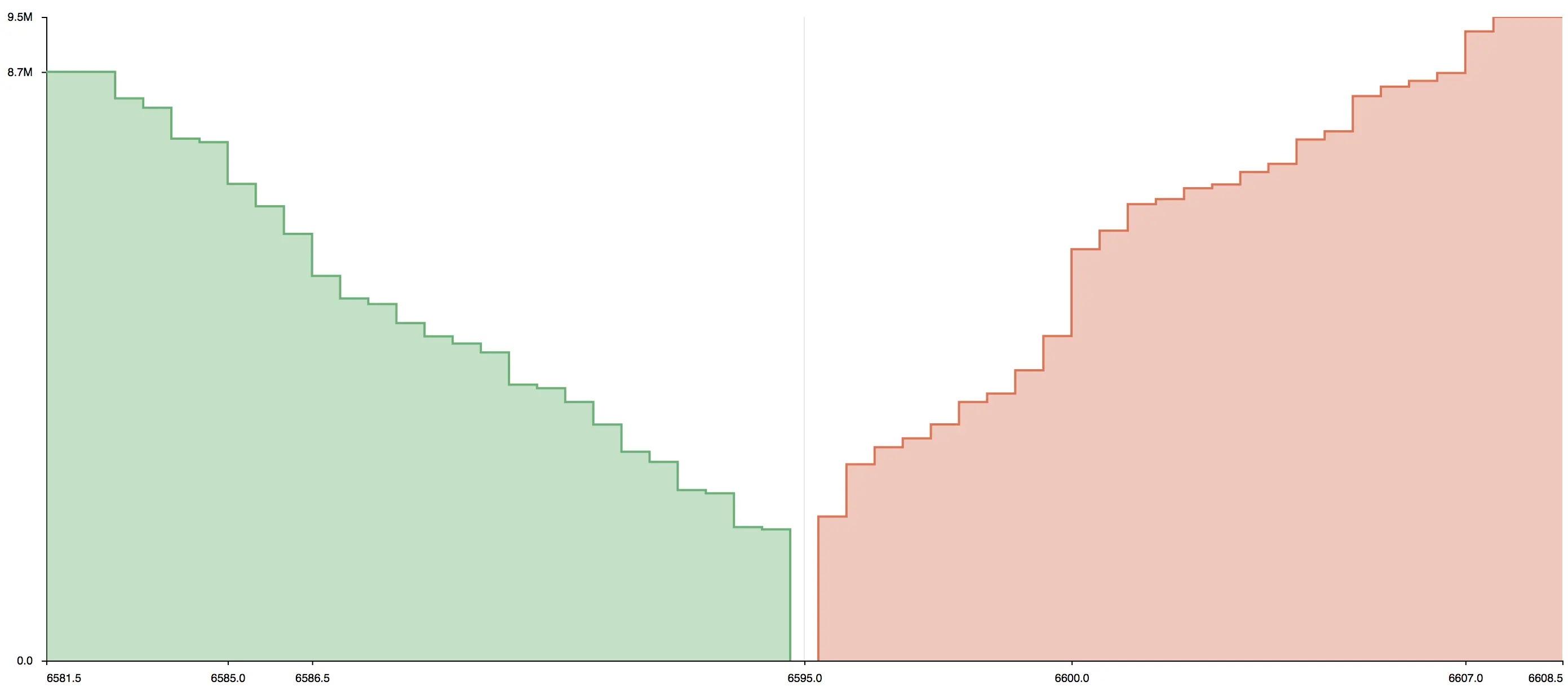

Buy and sell walls are created when there’s an accumulation of buy or sell orders at a particular price point. A buy wall forms when the demand to buy a cryptocurrency at a specific price outweighs the selling pressure. Contrarily, a sell wall arises when there are more sell orders at a certain price than there are buyers. These walls often represent strong market sentiment and can impact the price movement of the cryptocurrency.

However, these walls can also be a result of market manipulation tactics by whales. They can create false buy or sell walls to sway the market sentiment in their favor. The Aesir provides the tools necessary to analyze these walls effectively and make informed trading decisions.

Cryptocurrency Trading Bots: Timely Detection and Response

Cryptocurrency trading bots provided by AESIR are designed to scan the market continuously, identifying the formation and dissolution of buy and sell walls. These bots can respond to market movements quickly and execute trades, capitalizing on these market dynamics while maintaining efficiency.

Risk Management: Stop-Loss and Trailing Stops

To help traders safeguard against significant losses resulting from abrupt market changes, Aesir offers effective risk management tools like stop-loss orders and trailing stops.

Stop-loss orders are designed to limit a trader’s loss by automatically selling a cryptocurrency when its price falls to a certain level. It provides a safety net, reducing potential losses during rapid market downtrends.

Trailing stops, on the other hand, are dynamic. They adjust with the market price, providing protection for profits while limiting losses. As the cryptocurrency’s price rises, the trailing stop will move up correspondingly. However, if the price drops, the stop level remains the same. This allows traders to lock in profits and prevent losses if the market suddenly turns volatile.

Conclusion

Navigating buy and sell walls is a fundamental aspect of algorithmic cryptocurrency trading. With an advanced trading platform like AESIR, traders gain access to efficient trading bots and powerful risk management tools. These resources provide them with the ability to analyze and react to buy and sell walls effectively, ensuring informed decision-making, safeguarding investments, and enhancing overall trading performance.

Don’t forget to join our discord to stay up to date with our trading bot tutorials!