How to use cryptocurrency volatility to your advantage with algo trading

Sun Apr 02 2023

Æsir offers a novel approach to algorithmic cryptocurrency trading with our unique Volscan module that can detect potential spikes in cryptocurrency prices before they happen.

Let’s talk cryptocurrency volatility, and how you can use this to your advantage.

If you’re here, you’re probably already familiar with the fact that certain cryptocurrencies experience substantial spikes, surging by 1000% or more. These elusive 10x gains pique the interest of many traders. A common approach to capture these spikes is to purchase small amounts of various lesser-known coins, hoping that one or two will reveal themselves as hidden gems. However, this strategy often falls short, and a more precise alternative is necessary.The alternative strategy we propose is relatively simple, but it does require an algorithmic trading approach.

Using Æsir’s volatility module, your algorithm will continuously monitor the prices of all assets on a crypto exchange. If an asset’s value increases by more than a predetermined percentage within a specific timeframe, the algorithm will purchase that asset. You will need to experiment with various parameters to optimize the strategy. Additionally, an exit strategy is crucial so we recommend employing a trailing stop loss to sell at the peak.

This is not financial advice and caution is required when configuring an algorithmic trading strategy. We highly recommend testing your strategy in Paper Trading mode before doing any form of live trading.

Setting up your volatility trading algorithm

Now, let’s dive into the implementation of this crypto volatility trading strategy using Æsir:

- Register an account on our algorithmic crypto trading platform, Æsir.

- Navigate to “Create New Strategy” in the sidebar.

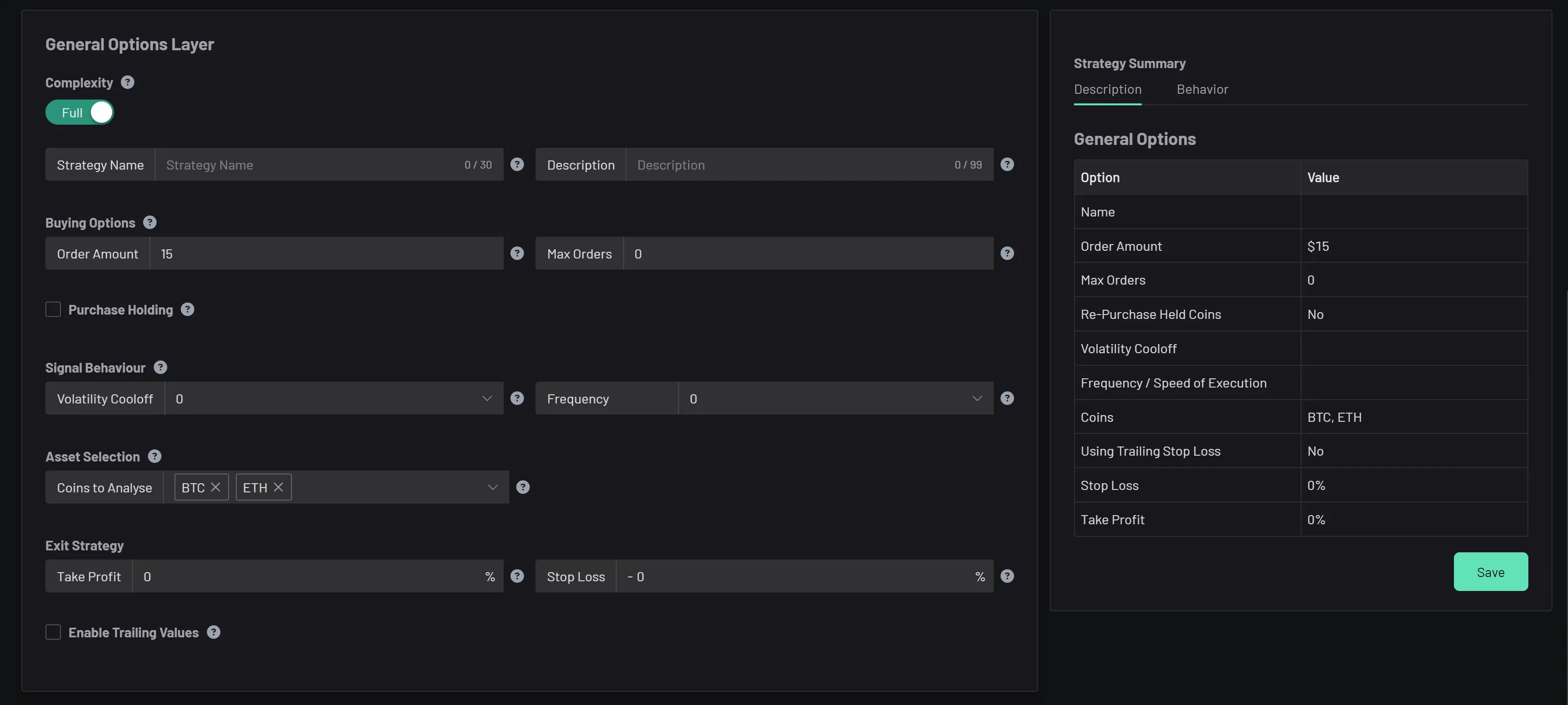

- Complete the basic configuration options, such as Strategy Name, Description, Amount Per Trade, and Maximum Open Orders. Enable the Purchase Holding checkbox if you prefer the strategy to buy assets it already holds.

- Configure a Volatility Cooloff to prevent purchasing the same coin within a brief period.

- Under Asset Selection, deselect BTC and ETH to enable the strategy to scan all coins on the exchange. However, if you wish to apply this strategy to specific coins, feel free to include them in your selection.

- Set your Take Profit and Stop Loss values. Remember, with a Trailing Stop, your Take Profit represents the threshold at which the trailing values are activated. For example, if your Take Profit is 3% and your Trailing Take Profit and Trailing Stop Loss are 2%, once a trade gains 3%, the Take Profit will increase to 5% and the Stop Loss to 1% — locking in profit. This process continues as long as the movement remains positive.

- Enable Trailing Values and input your Trailing Stop Loss and Trailing Take Profit values.

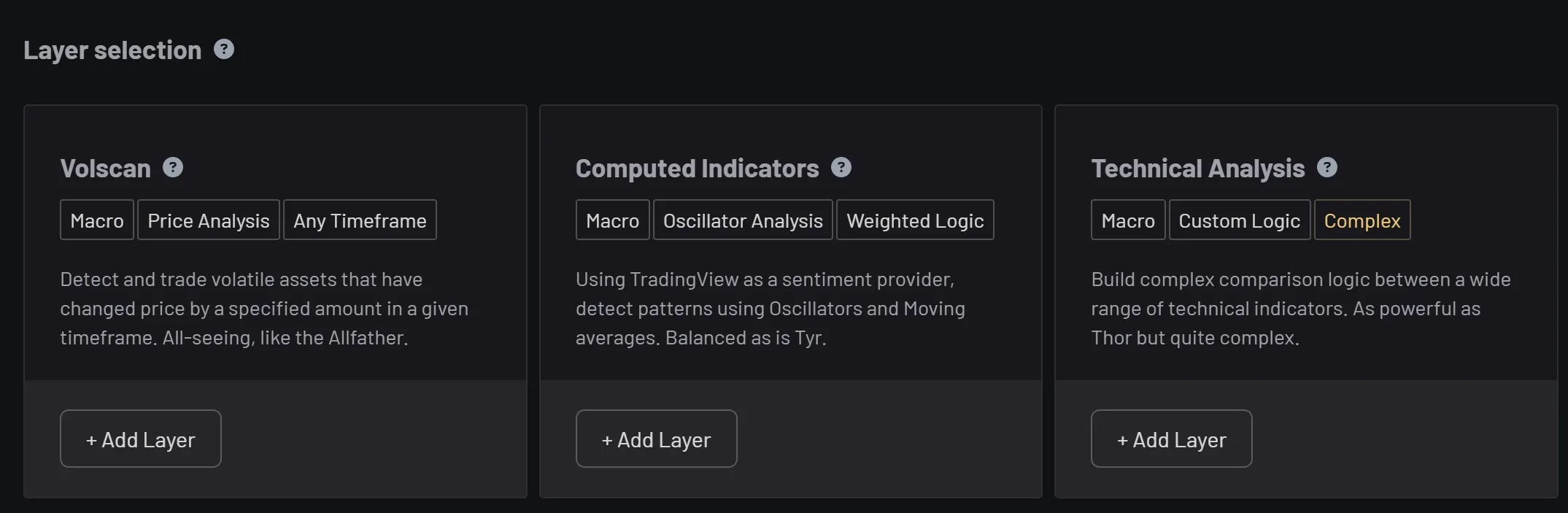

- Scroll down and select the Volscan layer. This module scans the selected assets and checks whether they have gained more than a specific percentage within a set time window.

- Finally, add your desired Price Change percentage and Volatility Window.

That’s it! Navigate to the “My Strategies” screen and start your strategy. We advise beginning in paper trading mode to test its performance without using real funds. From here, it’s a matter of gauging performance and making adjustments to the Trailing Values. Usually, what sets a good strategy apart from a bad one are just minor changes to the existing parameters.

We obviously can’t make any recommendations on what values to set to those parameters, so it’s up to you to discover what kind of approach works for you in the current market conditions.

But you can join our Discord and discuss strategies, and algo trading with out growing community!