How to use a Trailing Stop Loss in Algorithmic Cryptocurrency Trading

Thu Jul 06 2023

A Trailing stop loss and Trailing Take Profit can help you maximize your gains and reduce your risk by keep your positions open for as long as the market trend continues. Continue Reading.

Our revolutionary algorithmic cryptocurrency trading platform, Aesir, provides traders with a variety of tools and features to help them make informed decisions and maximize their profits. One such feature is the Trailing Stop setting, which is not available on most exchanges.

What is a Trailing Stop and How Does it Work?

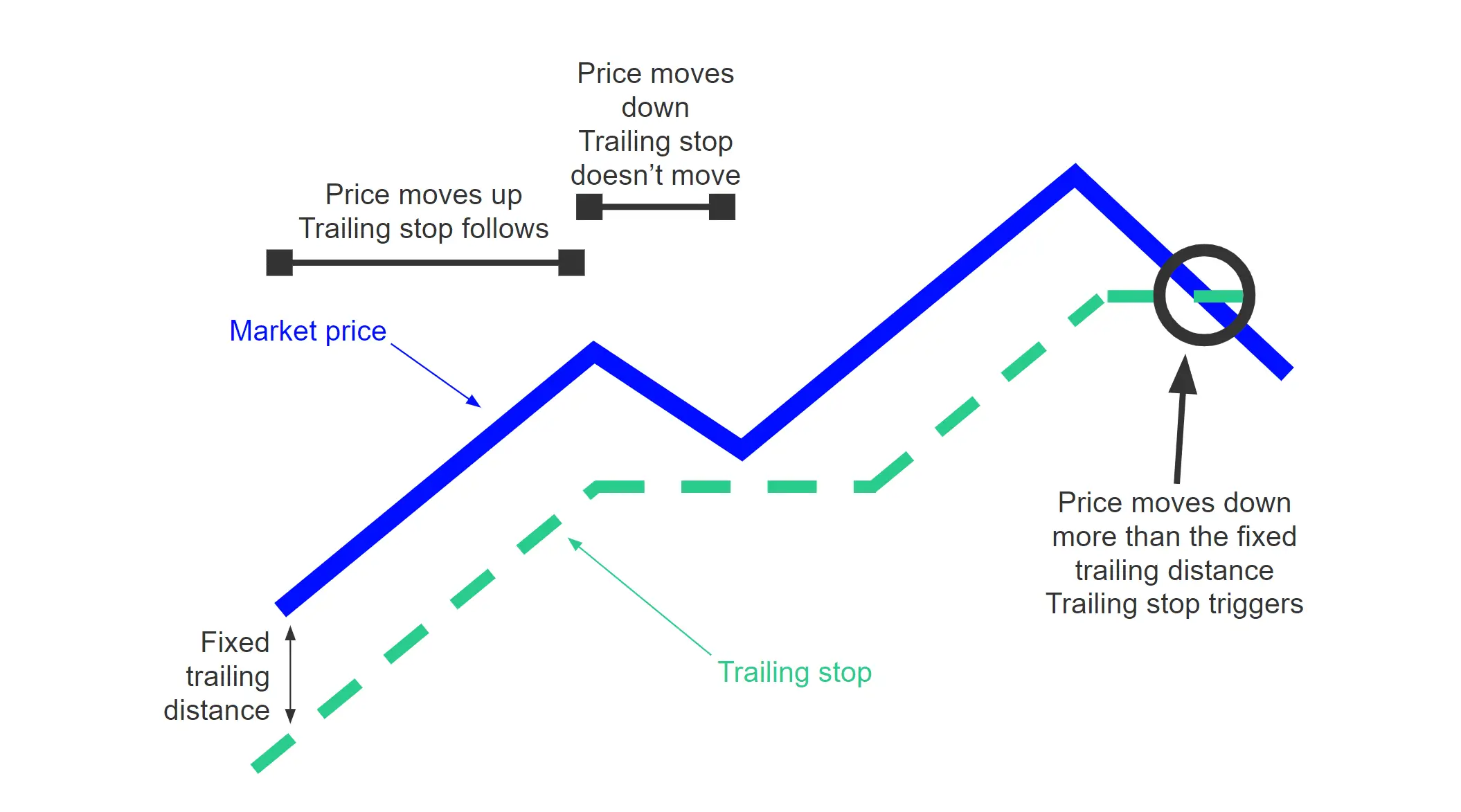

A Trailing Stop is a stop order that can be set at a defined percentage away from a coin’s current market price. The order closes the trade if the price changes direction by a specified percentage. This allows traders to protect their gains by enabling a trade to remain open and continue to profit as long as the price is moving up.

To better understand how it works, let’s look at an example. Suppose you enter into a transaction at a certain level, and the coin’s price begins to rise. As we don’t know whether the price will continue to rise, a Trailing Stop will allow you to secure profits at a certain level. For instance, a 5% Trailing Stop will enable you to lock in profits once the price reaches a certain percentage away from the current market price.

The great thing about a Trailing Stop setup is that your trade remains open for as long as the desired trend continues. So if your asset goes up by 25% your Trailing Stop is now set to 25% profit, and you have successfully locked in this gain. If the asset price increases, your Trailing Stop keeps moving up, following the asset price.

A trailing stop can optimize your risk management by ensuring that you make the most out of each of your trades, and can completely turn a strategy around if used correctly.

Using Trailing Stops on Aesir

To use Trailing Stops on Aesir, simply enable and configure the feature on the Strategy Creation Screen. Once you enable this option, you will see two new fields: a Trailing Stop Loss and a Trailing Take Profit. The Trailing Take profit is the upper band of your Trailing Stop setup. For instance setting this to 2% will move bot your Trailing Stop Loss and your Trailing Take profit up, as this threshold is reached by your crypto trading bot.

The Trailing Stop Loss is your lower band, this follows the price minus the percentage given and is responsible for closing the trade once the price drops below that level. The two combined make up you Trailing Stop strategy. Unlike Other platforms where you only have a single value, Aesir allows you to control precisely when to follow the price but defining your Trailing Take Profit.

Advantages of Using Trailing Stops In Algorithmic Trading

Trailing Stops offer a range of advantages for algorithmic cryptocurrency traders. Firstly, they allow traders to capture as much of the rise as possible while protecting against potential price reversals. Secondly, they are convenient and easy to use. Finally, they offer downside protection, ensuring that traders can lock in profits and minimize losses.

Conclusion

In conclusion, Trailing Stops are an essential tool for algorithmic cryptocurrency traders looking to maximize their profits and minimize their losses. By utilizing this feature on Aesir, traders can protect their gains, capture the rise of an asset’s price, and secure their profits. Sign up for a free trial period on Aesir to access all the trading tools and features available, including Trailing Stops, CopyTrading, Paper trading mode and more!