How to build volatility, TA and Tradingview Cryptocurrency Trading Bots with zero code

Mon May 22 2023

On Algorithmic crypto trading platform Æsir you can easily build a crypto trading bot designed to take advantage of multiple signals at one, using our intuitive interface.

We just released Æsir last week, and it’s been received very positively which makes us all incredibly happy and humbled with the first big step of our journey so far.

What makes crypto trading bot platform Æsir special is that it allows traders to take advantage of trading signals in a unique that, by allowing them to build complex logic using multiple types of analysis.

Let’s dive into how Æsir works and how you can use it in algorithmic cryptocurrency trading:

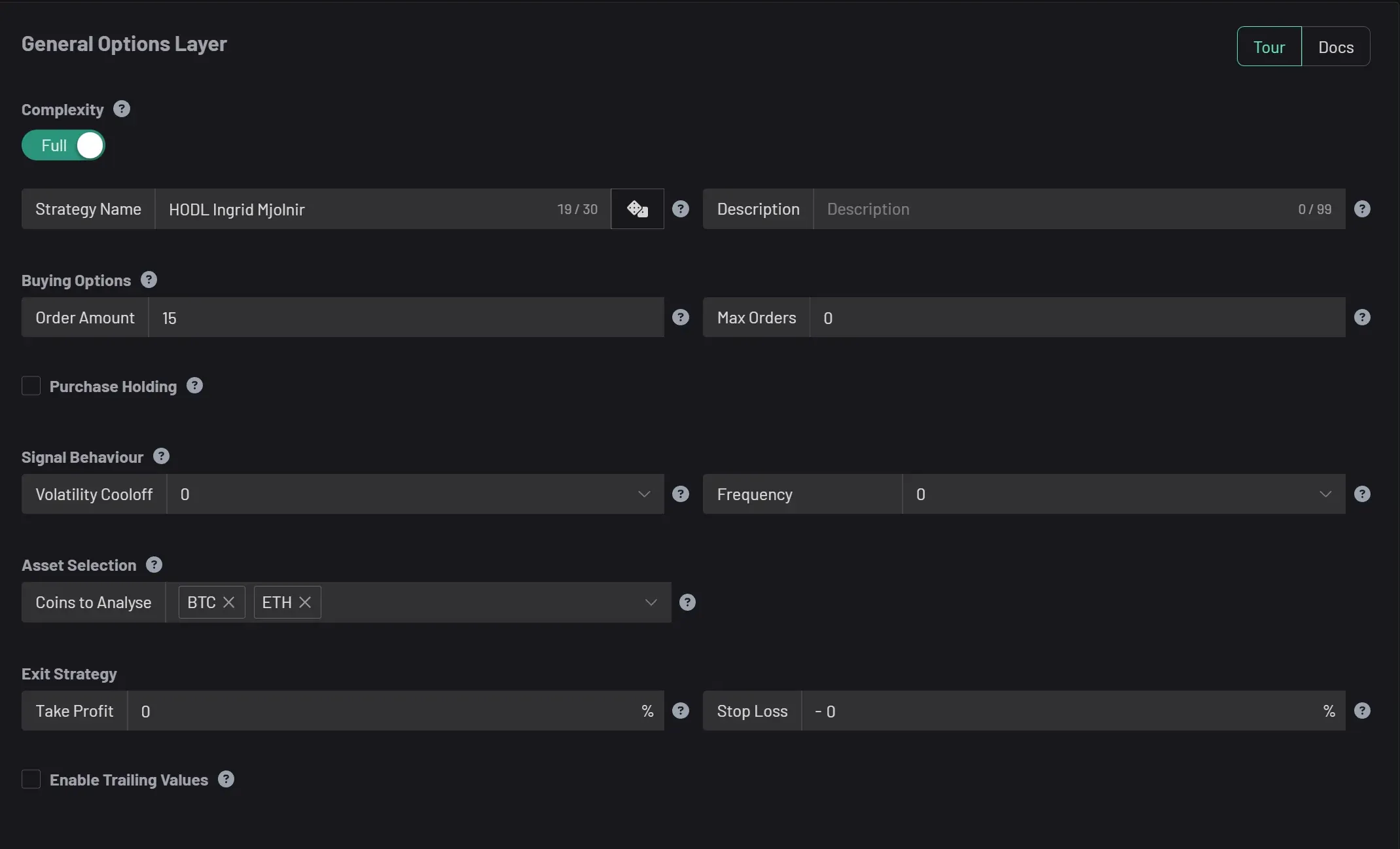

You start by choosing your general settings. These apply to all types of trading bots that you’re going to build and generally include settings like amount spent per trade, exit strategy and more.

Order Amount: The amount each trade will be placed for

Max Orders: The maximum number of open orders that the bot will manage.

Purchase Holding: Whether to buy an asset that has already been bought.

Volatility Cooloff: For how long to ignore a buy signal from an asset that has just been bought.

Frequency: How often to check the buy conditions

Coins to Analyze: Coins to include in analysis. Leaving it empty will analyse ALL coins on the exchange.

Take Profit / Stop loss: % of gain or loss at which a trade will be closed.

Trailing values: Allows the use of a Trailing Stop loss, which is an improved version of the normal Take Profit / Stop Loss paradigm. It allows you to ride an upwards trend for as long as the trend continues.

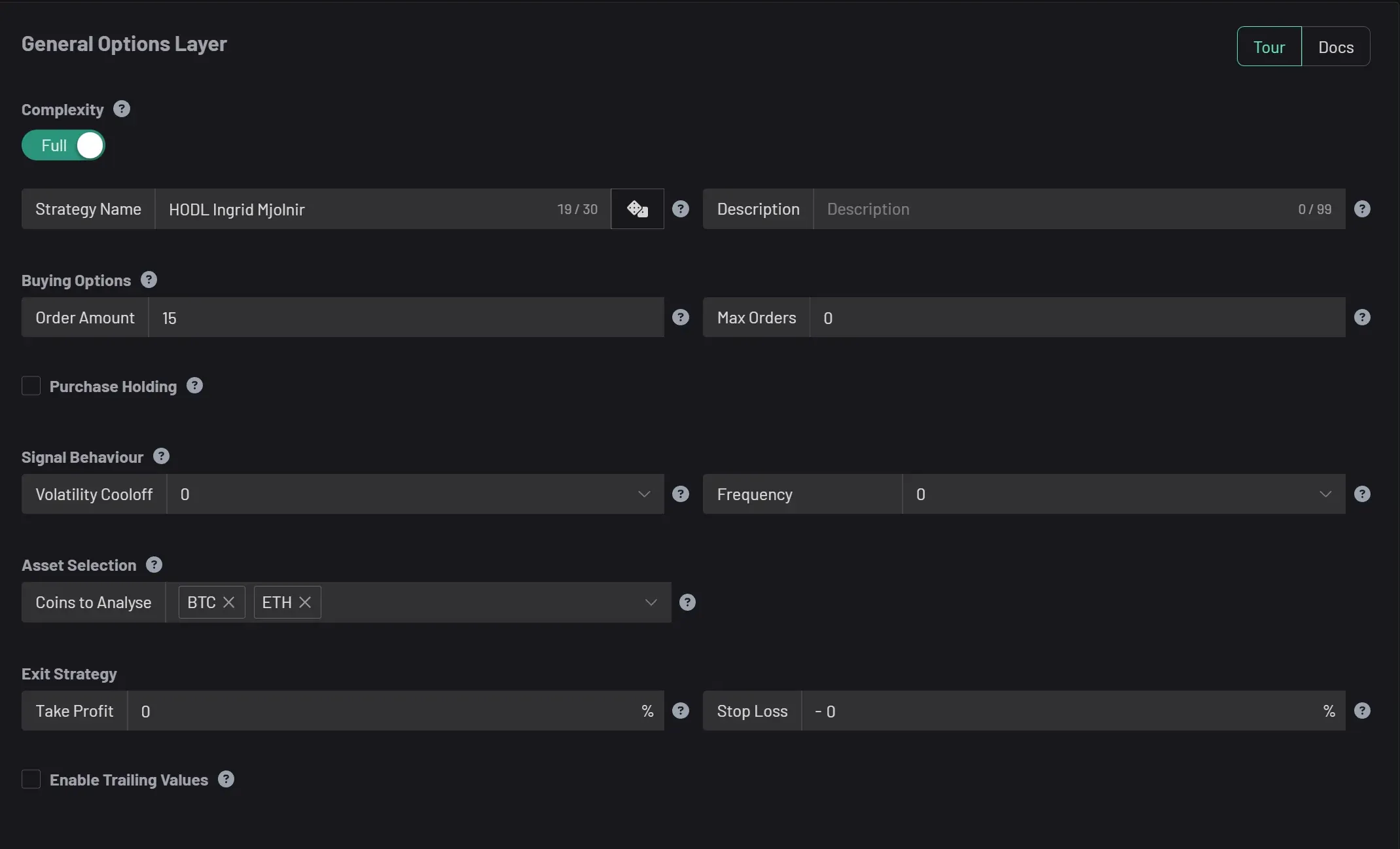

With the general settings out of the way, we must now build an actual strategy and its logic. The above determines how a bot behaves when buying and managing assets, but doesn’t tell it what to do and when to buy an asset. This is where we’ll need to add a logic layer.

Æsir comes with 3 types of Logic layers and the great this is you can stack them on top of each other to create really unique signals.

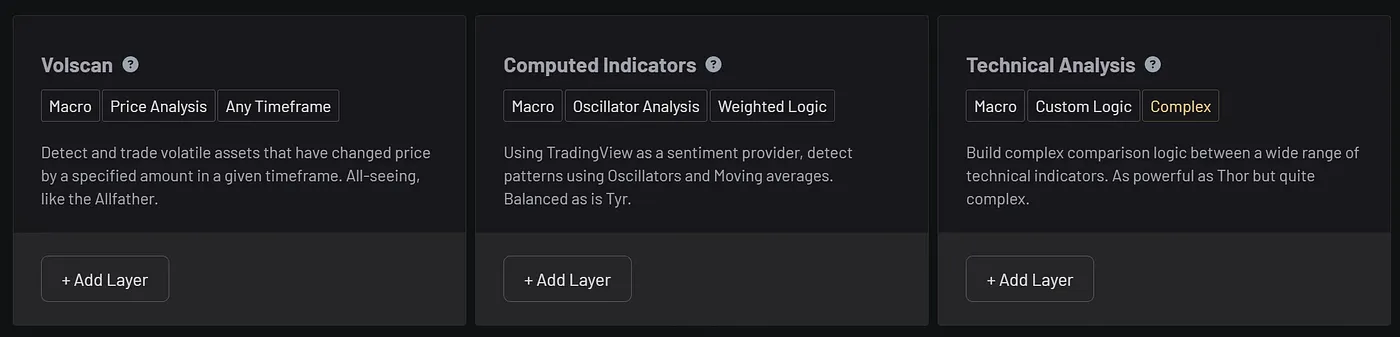

The Volscan Layer is basically the volatility bot that I described above. It generated buy signals based on asset volatility. For instance the setup below will aim to generate buy signals on the coins selected in the General Options layer, once the Price fluctuates by more than 3% in 30 seconds.

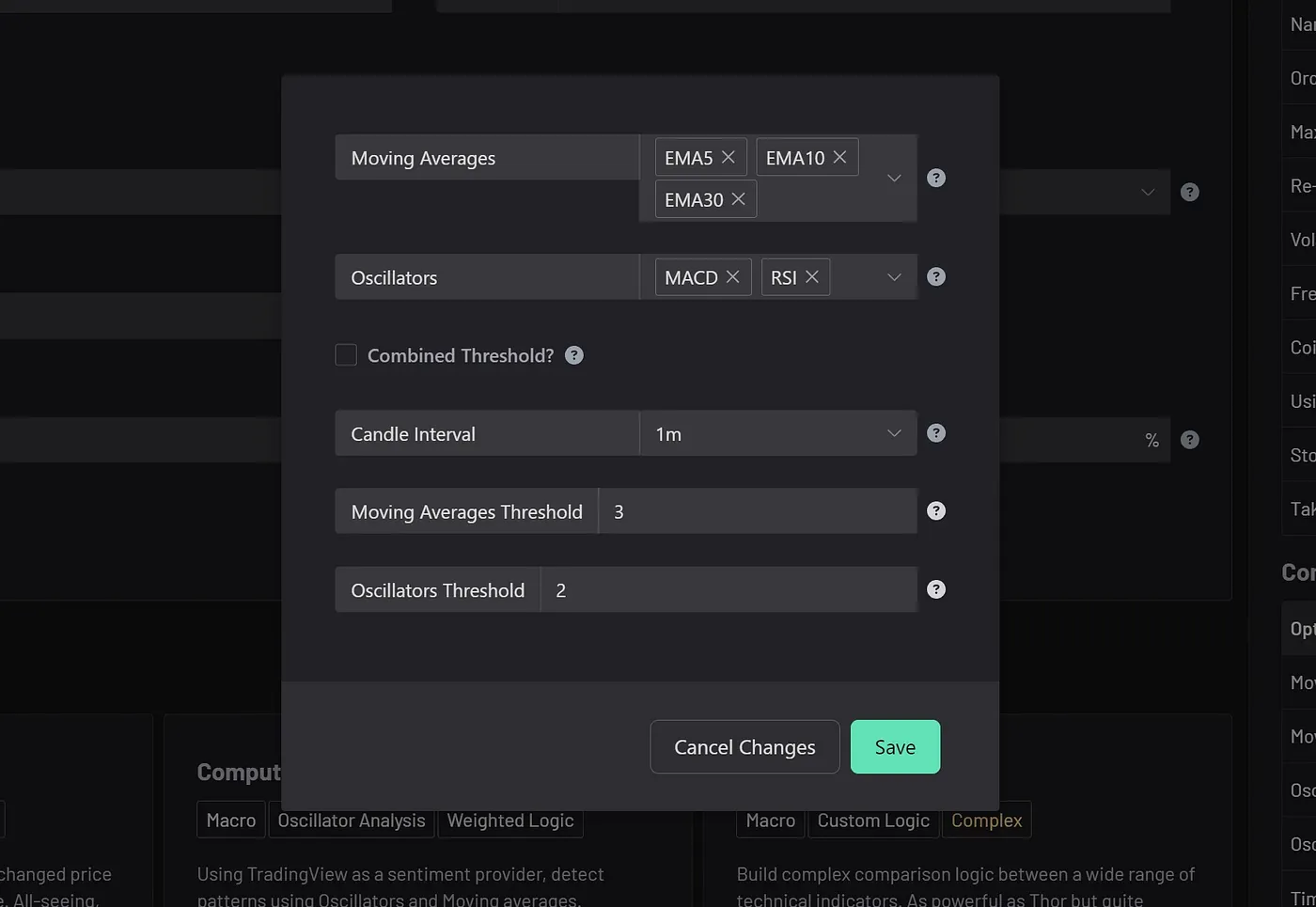

But you can keep building complexity. Adding a new Layer will make the Bot evaluate both layers, and only buy an asset once both layers signal a buy. In addition to the logic above, we’re also adding a Computed Indicators layer that uses TradingView signals for Moving Averages and Oscillators.

The condition in here means that in addition to the Volatility logic, the coins selected in General Options must also have buy signals generated on EMA5, EMA10, EMA30, MACD and RSI --- according to Tradingview.

Note the Threshold fields --- This represent how many of the MAs or Oscillators above need to be positive to return a buy signal. Right now it’s 3/3 and 2/2 but you could make it so that any 2 Moving averaged need to return a buy signal, not all 3. Same for Oscillators.

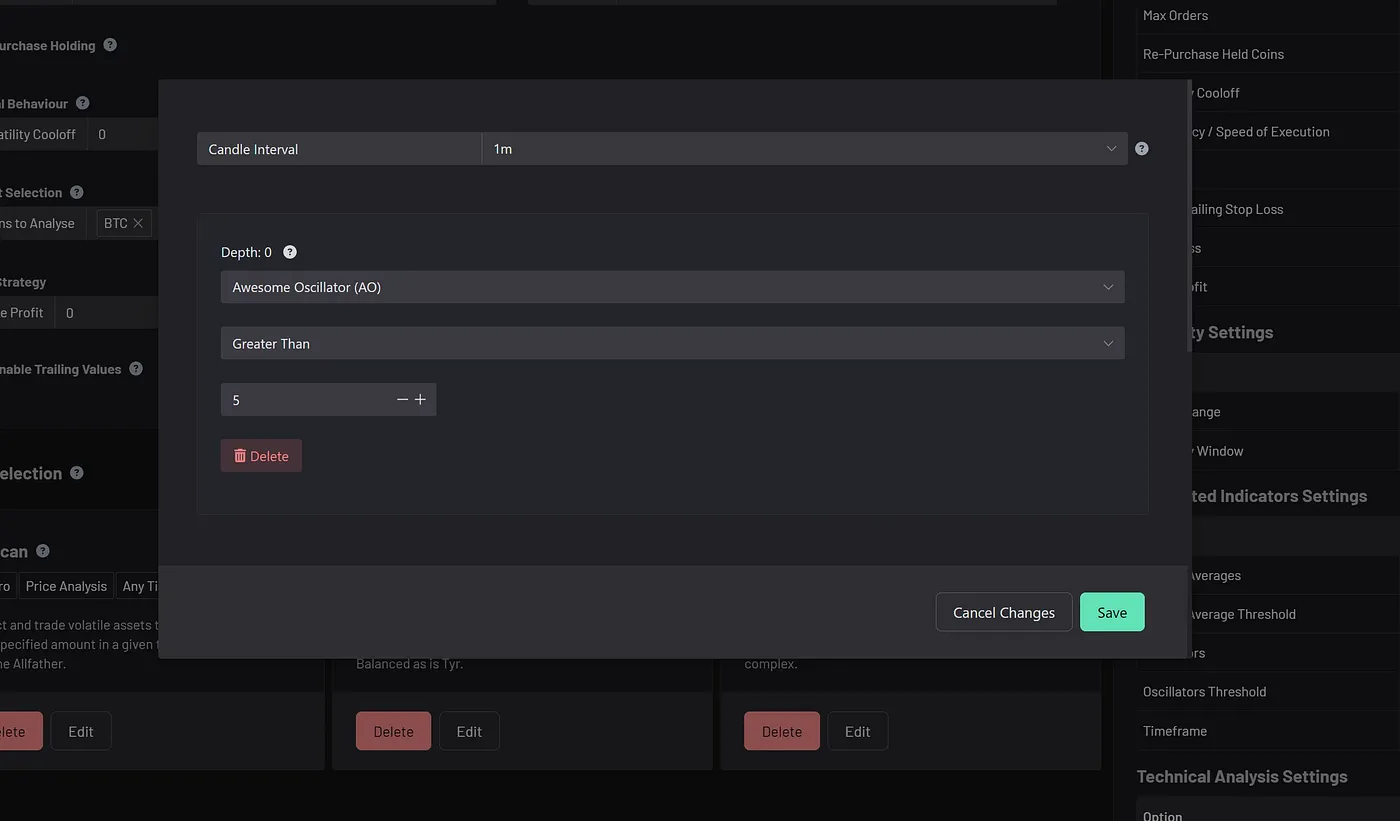

Finally, adding a Technical Analysis Layer means that now all 3 Layers must generate a buy signal.

We opted for a single condition: Awesome Oscillator is greater than 5, but the TA module itself can create complex nested TA logic.

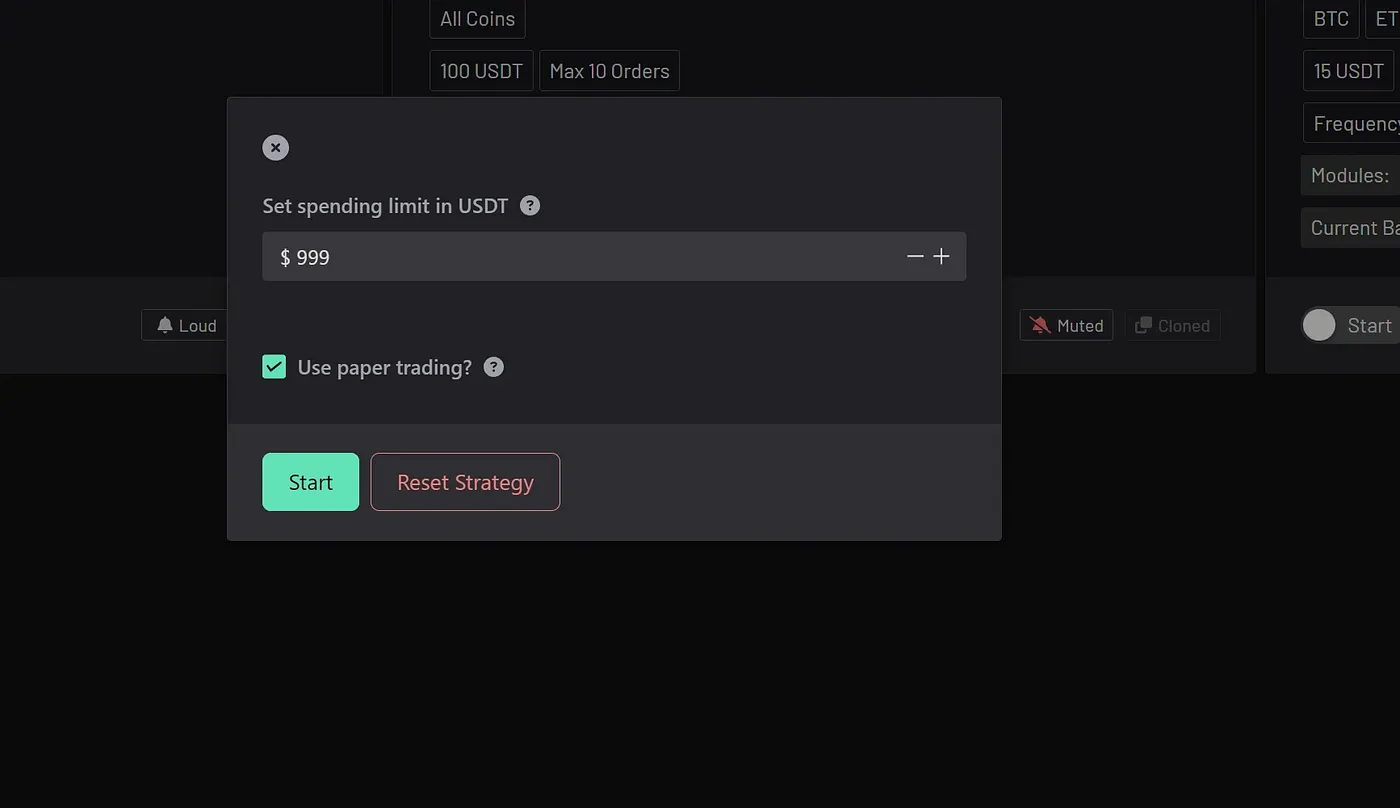

Once the config is saved, you can easily run it in paper trading mode:

Naturally, you can choose to only use 1 or 2 of these layers and configure them to your own needs. Each layer is a powerful tool in itself, but combining them will help you find unique and under-explored signals in the market.

Build your own at: https://aesircrypto.com

And don’t forget to join our growing algo trading community on Discord!

Skål!