Comprehensive Guide on Technical Analysis In Cryptocurrency Trading

Tue Aug 01 2023

Technical Analysis can be traced back to the 20th century and a crucial tool in every cryptocurrency trader's arsenal. Here are some of the key concept surrounding it.

Cryptocurrency trading is an attractive investment option for many enthusiasts and professionals alike. Amidst the volatility and potential for high returns, traders often employ various strategies to gain an edge. One such strategy is Technical Analysis, a method that involves studying historical price data and market statistics to predict future price movements.

Introduction to Technical Analysis

The origins of technical analysis can be traced back to the late 19th and early 20th centuries. Charles Dow, who co-founded Dow Jones & Company and The Wall Street Journal, is often credited as one of the pioneers of technical analysis. Along with his business partner Edward Jones, Dow developed a series of stock market indices and published his observations on market movements, which later became known as the “Dow Theory.”

While Dow laid the foundation for technical analysis, other notable figures also made significant contributions to its development. One such individual is Richard W. Schabacker, who is often considered the father of technical analysis. He wrote the book “Technical Analysis and Stock Market Profits,” which was published in 1932 and is still considered a classic in the field.

Technical Analysis is a widely used trading method that relies on historical price data, charts, and indicators to forecast future price movements. In cryptocurrency trading, Technical Analysis plays a crucial role due to the volatile nature of digital assets. Traders use various tools and patterns to identify trends, support and resistance levels, and potential entry and exit points.

Key Concepts in Technical Analysis

1. Candlestick Patterns

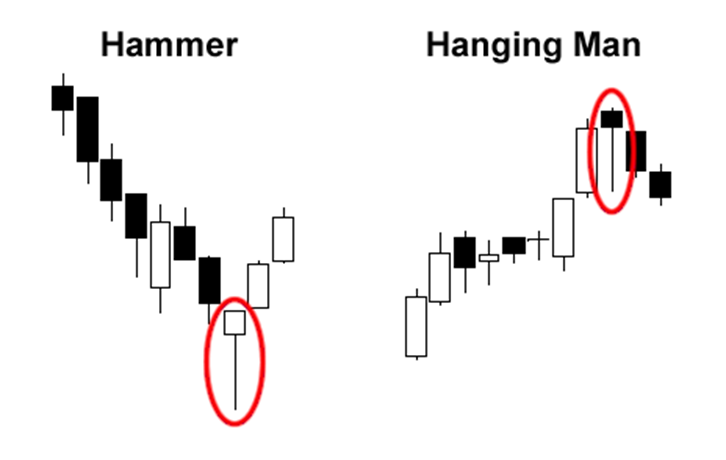

Candlestick patterns are a fundamental aspect of Technical Analysis. They provide insights into price action, showing the opening, closing, high, and low prices for a specific period. Traders often use patterns like Doji, Hammer, and Engulfing patterns to identify potential trend reversals or continuations.

2. Support and Resistance Levels

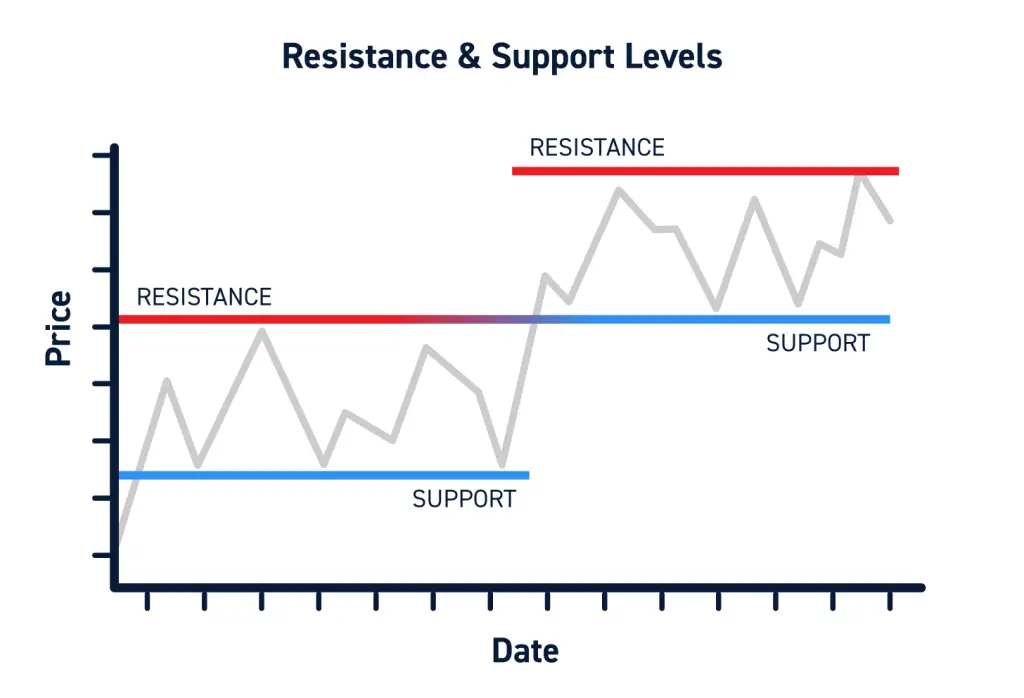

Support and resistance levels are price levels where the market tends to show a significant amount of interest. Traders use these levels to determine potential entry and exit points as prices tend to react at these levels.

3. Moving Averages

Moving averages smooth out price data and provide a clearer view of the trend. Traders often use simple and exponential moving averages to identify trend changes and potential crossovers.

4. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought or oversold conditions, indicating potential price reversals.

5. Fibonacci Retracement

Fibonacci retracement levels are based on mathematical ratios and are used to identify potential support and resistance levels. Traders use these levels to anticipate potential price reversals during a trend.

Applying Technical Analysis in Cryptocurrency Trading

1. Identifying Trends

One of the primary objectives of Technical Analysis is to identify trends in cryptocurrency price movements. By recognizing uptrends, downtrends, or sideways movements, traders can tailor their strategies accordingly.

2. Entry and Exit Points

Technical Analysis helps traders identify optimal entry and exit points for their trades. By using various indicators and patterns, traders can time their trades to maximize potential profits and minimize losses.

3. Risk Management

Proper risk management is crucial in cryptocurrency trading. Technical Analysis assists in setting stop-loss levels and determining position sizes, helping traders limit their losses in case the market moves against their expectations.

4. Backtesting Strategies

Before deploying a trading strategy, traders often backtest their approaches using historical data. This helps assess the strategy’s performance and validate its potential profitability.

The Role of Algorithmic Cryptocurrency Trading Platforms

1. What are Algorithmic Cryptocurrency Trading Platforms?

Algorithmic cryptocurrency trading platforms leverage computer algorithms to execute trades automatically. These platforms are designed to analyze vast amounts of data and execute trades based on predefined rules and strategies.

2. Benefits of Using Algorithmic Platforms

Algorithmic platforms offer several advantages, such as high-speed execution, reduced human error, and the ability to trade 24/7. They also enable traders to backtest strategies on historical data and implement complex trading approaches.

3. Popular Algorithmic Cryptocurrency Trading Platforms

Some well-known algorithmic cryptocurrency trading platforms include Aesir, 3 Commas, and Cryptohopper. These platforms cater to different levels of expertise and trading preferences.

Combining Technical Analysis with Algorithmic Trading

1. Advantages of Integrating Technical Analysis with Algorithmic Trading

Integrating Technical Analysis with algorithmic trading can enhance the accuracy and efficiency of trading strategies. By leveraging both approaches, traders can develop more robust systems and adapt to changing market conditions.

2. Developing a Profitable Trading Strategy

Creating a profitable trading strategy involves thorough research, testing, and fine-tuning. By combining Technical Analysis with algorithmic trading, traders can develop strategies with a higher probability of success.

3. Avoiding Common Pitfalls

While combining Technical Analysis with algorithmic trading can be powerful, traders should be aware of potential pitfalls, such as overfitting, data snooping, and system bugs. Regular monitoring and updates are essential to avoid such issues.

The Future of Technical Analysis in Cryptocurrency Trading

As the cryptocurrency market continues to evolve, Technical Analysis will remain a crucial tool for traders. The integration of AI and machine learning in algorithmic platforms and trading bots will likely lead to more sophisticated strategies and increased efficiency.

The best way is to learn by doing, so why not take Æsir for a spin. See you around!