How to Configure the Coinbase Volatility Trading Bot On Aesir

Sun Aug 06 2023

Volatility is one of the defining factors of Cryptocurrency markets. Aesir's Coinbase Volatility Trading bot can help you maximize your gains by buying into volatile assets at just the right time.

If there is one thing that’s guaranteed in life, it’s the volatility of the cryptocurrency market. This makes bot a very lucrative and relatively high risk market from a trader’s point of view. Cryptocurrency trading bots are used as a means to detect and capitalize on certain market movements in order to make a profit. There are hundreds of strategies to choose from however, in this article we’ll be focusing on a tool that’s unique to our algorithmic crypto trading platform, Aesir.

Introducing Aesir’s Unique Coinbase Volatility Trading Bot

Originally named the “Volatility Trading Bot”, Aesir’s Volscan Module allows you to trade the cryptocurrency market based on pure volatility. Unlike other signals or bots out there, the coinbase volatility trading bot allows for near limitless customization of the volatility threshold that your strategy will be based on. The best thing about it is that it can scan all assets on Coinbase in under a few seconds, making it one of the fastest trading tools on the market.

Configuring The Coinbase Volatility Bot On Aesir

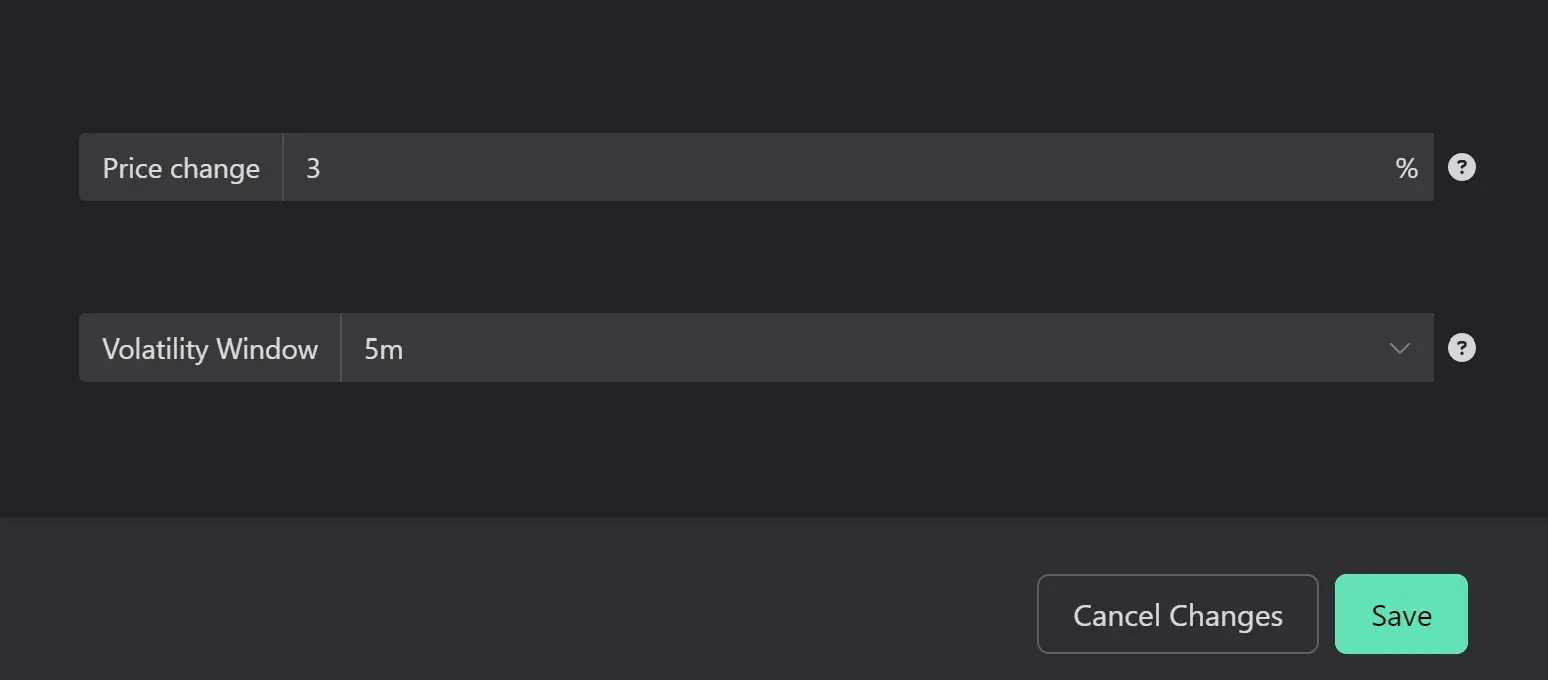

Within the Volscan module, you have two main adjustable options: the Price Change and the Volatility Window. By fine-tuning these selections, you can tailor a volatility trading bot that aligns perfectly with your preferred trading approach.

For instance, you could set your trading bot to purchase any coin on coinbase that has risen by more than 3% in the last five minutes – a short-term volatility strategy. However, both the Price Change % and Volatility window can be customized to suit any trading style you desire.

The Coinbase Volatility trading bot is versatile enough to identify short or long-term volatility and even be attentive to potential price spikes, which could lead to significant gains. Nevertheless, finding the optimal settings requires some trial and error. Therefore, it is recommended to begin with paper trading mode and only transition to live trading once you have discovered the ideal combination that suits your objectives.

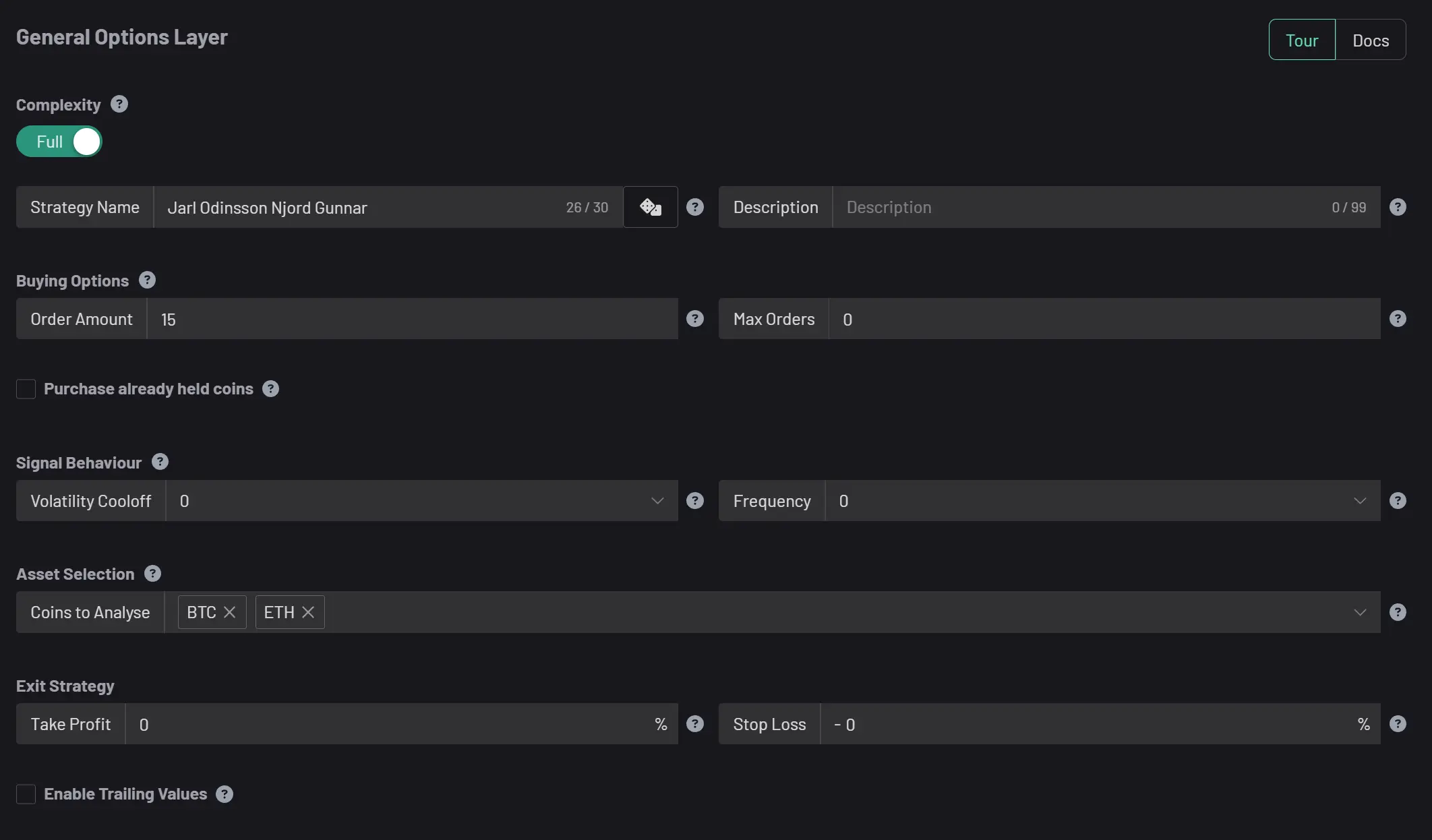

One of the key strengths of Aesir is its capacity to analyze all coins listed on Coinbase. If you opt not to specify any coins in the “Coins To Analyze” field, the bot will assess every available coin on the platform. Alternatively, you have the flexibility to focus on specific coins, providing you with precise control over your trading strategy.

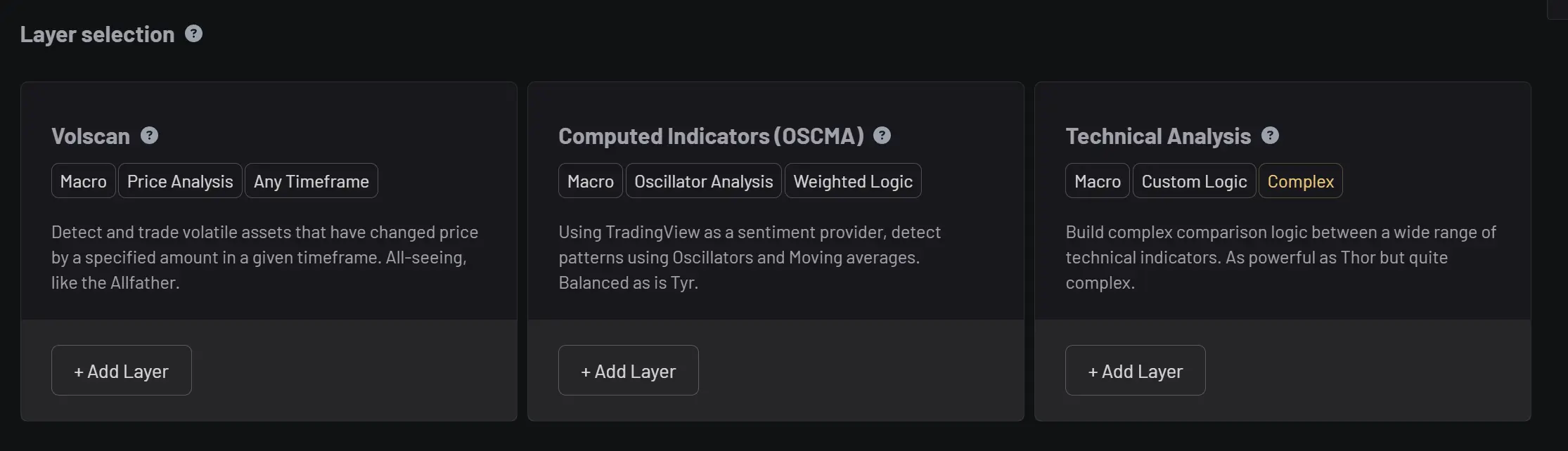

To get started with your Coinbase volatility trading bot, simply create an account on Aesir, Navigate over to Create New Strategy and select the Volscan Layer.

In addition to the specific logic of the Volscan layer itself, you will also need to configure some more general options for your trading strategy, such as the Amount to spend per trade, the Maximum number of open orders, as well as your Volatility Cooloff and your exit strategy in the form of Take Profit and Stop Loss. The volatility cooloff can be applied to any kind of strategy, but it’s particularly useful on the coinbase volatility trading bot. The cool-off tells the bot to ignore a buy signal for a certain period of time, if a previous buy signal was acted upon recently.

For instance, let’s say you configure your volatility bot to buy any coin on Coinbase whose price moves by more than 5% within the last 5 minutes. It just so happens that Bitcoin is moving a lot that day, so the bot buys Bitcoin at 11:55AM because it reached your specified volatility threshold. Immediately after, Bitcoin goes down by 2% and jumps back up by another 5% at 11:57. You may not want to place another buy order so close together, so you set a Volatility Cooloff of 15 minutes.

Creating a Coinbase API Key

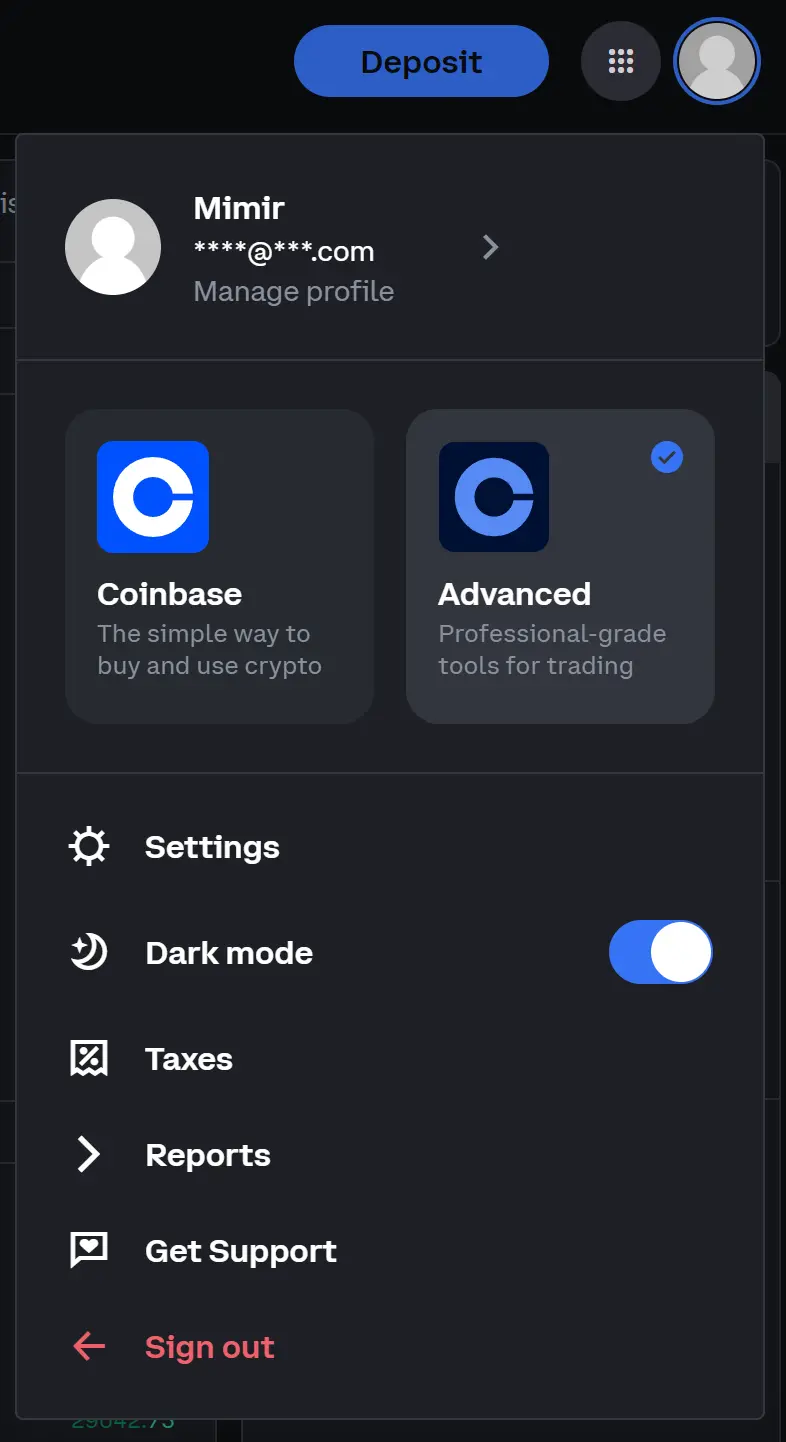

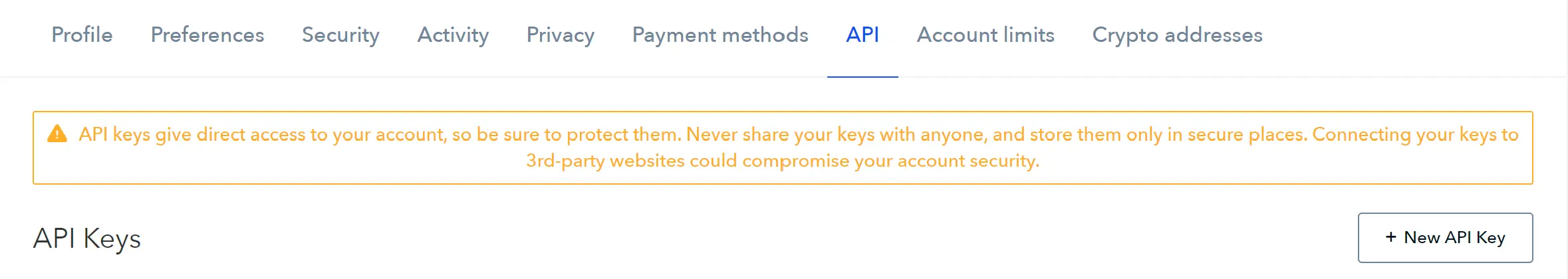

Naturally, in order to be able to run the Coinbase Volatility Trading Bot on the live exchange, you’ll need to provide Aesir with a set of Coinbase API Key and Secret that the bot can use to trade on your behalf. To create a coinbase API Key, simply Navigate to your profile and select Settings.

Now Navigate over to the API tab and click + New API Key. This will open a modal with different permissions that you will need to set for your Keys before you generate them. The correct trading permissions for the Coinbase API are wallets:trade:create and wallets:trade:read but you might want to enable wallets:transaction:read, wallets:buys:create, wallets:sell:create.

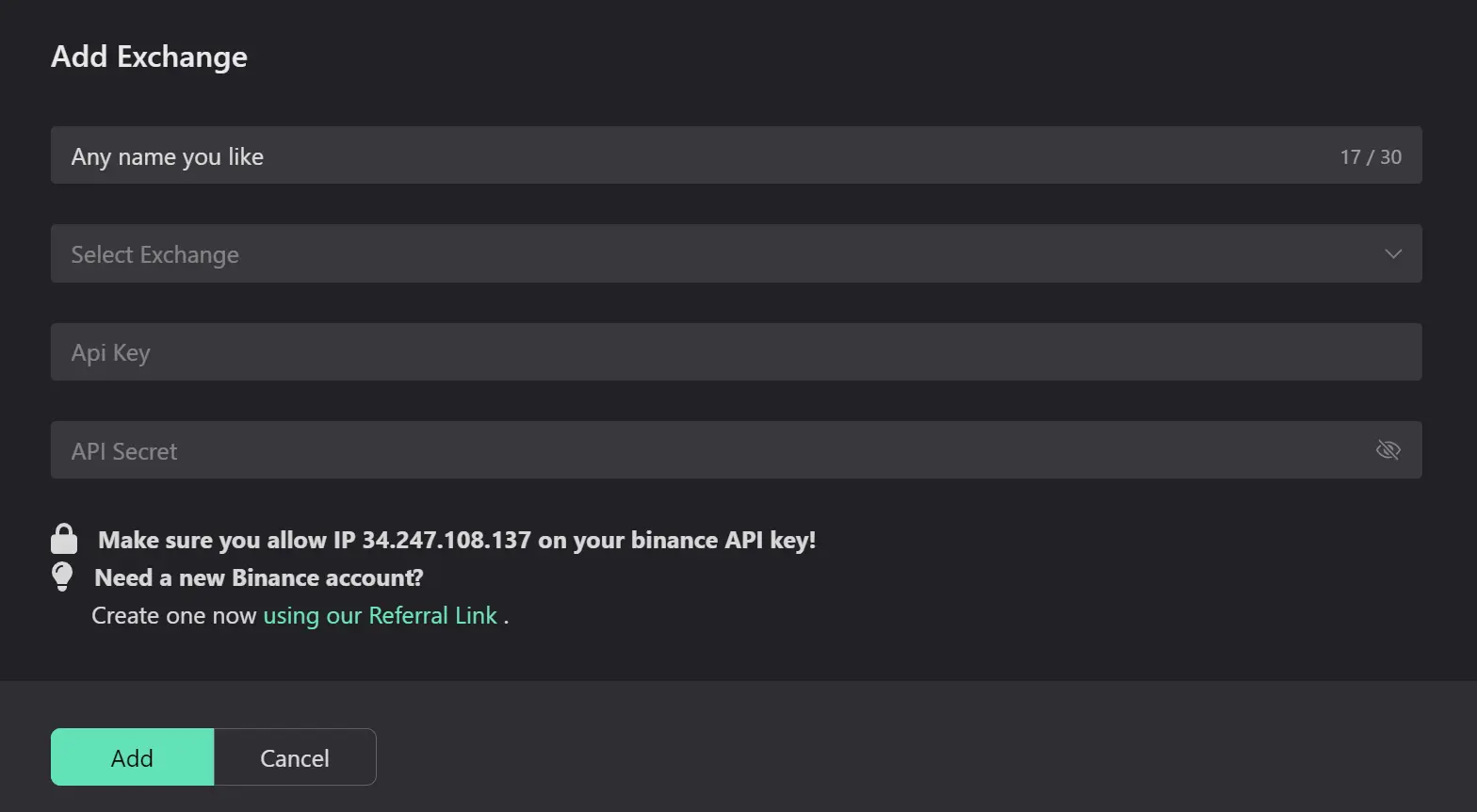

Finally, once you have your API Key and Secret from Coinbase, navigate over to Aesir > Profile and click Add Exchange on the top right side of the screen. This will open a modal where you will be able to add you Key, Secret and select the exchange that it’s for. Select Coinbase and hit Add. That’s it.

Manage The Risk of your Coinbase Volatility Trading Bot

Aesir allows you to manage the risk of your trading bots by configuring how you enter and exit the market. Aesir provides a fully customizable Trailing Stop Loss, an essential tool in the volatile crypto markets. This feature adjusts your stop loss level automatically as the price of your asset increases, securing your gains in case of a sudden market downturn.

On top of this, you can choose when you enter the market, by adding one or more confirmation layers to your Volatility bot. This can be good in order to exclude false positives. You might not want to buy on Volatility alone, so you can choose any other kind of signal that will also need to be evaluated as true before your bot places a buy order. For instance you can add a Technical Analysis layer and chose to only buy when the volatility criteria is met plus your EMA5, EMA10 and EMA20 are under 70. You can choose any number of indicators.

Remember, the best way to learn is by doing. Sign up to Æsir to get started and Join Our Discord (it’s good stuff).