How to configure a Binance Technical Analysis Crypto Trading Bot

Fri Aug 11 2023

Technical Analysis Bots allow traders to perform complex logical expressions in order to gain an advantage in the market. Here are two ways to build Binance TA bots on Aesir.

The cryptocurrency market is highly volatile, which makes it both a very appealing yet risky market to navigate from a trading perspective. Trading bots that react to market volatility are used to quickly detect and take advantage of a pattern in order to make a profit. There are many indicators and approaches to this, but in this article we’re going to cover a tool that’s unique to Aesir.

Although Crypto markets are different in many ways compared to stocks, Forex or other asset class, the importance of technical analysis when trading these markets is one thing they all have in common. A Binance Technical Analysis bot can help traders maximize gains and manage risks associated with trading.

Introducing Aesir’s Binance Technical Analysis Bot

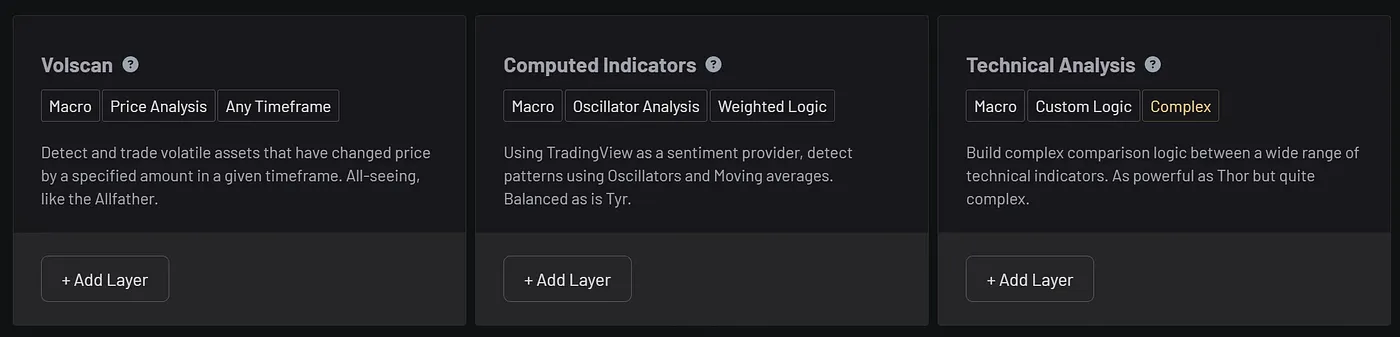

When it comes to Algorithmic trading for crypto, Aesir offers a versatile platform that allows traders to create truly unique signals by using Technical Analysis (TA). Aesir offers two distinct approaches to building a technical analysis trading bot on Binance, and other exchanges too. Let’s explore Aesir’s TA strategy builder.

Building a Binance TA Trading Bot using TradingView Indicators

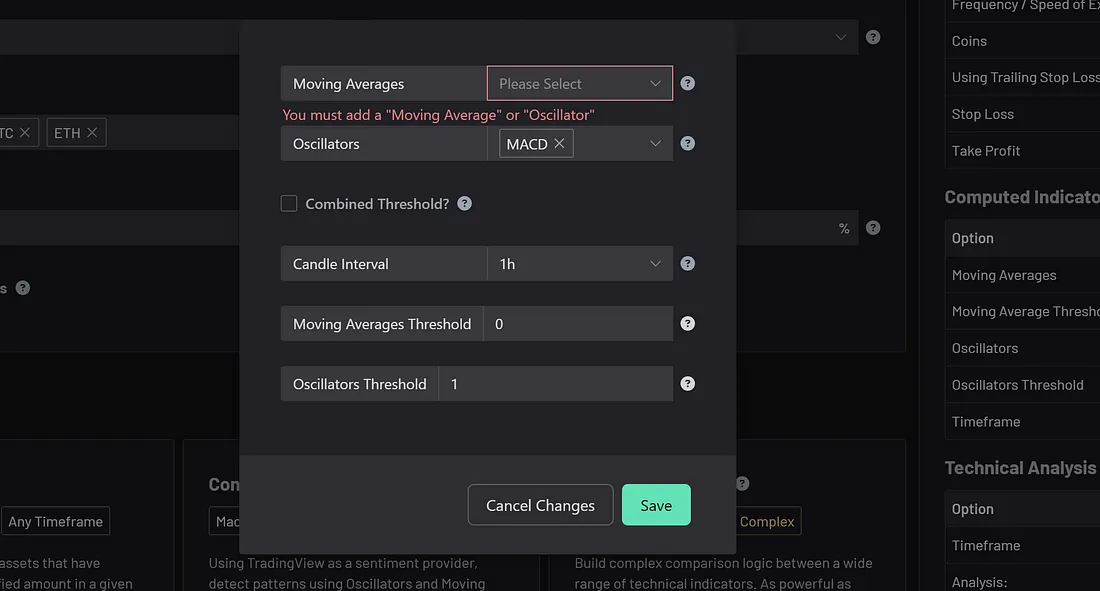

This Logic Layer allows you to use the power fo TradingView’s computed indicators in order to easily create new, powerful crypto trading bots using technical analysis. Computed indicators simply means that TradingView does the heavy lifting for your when determining when a specific indicator returns a buy signal. For instance: you don’t have to manually set RSI breaks 30, you would simply select RSI as the buy signal.

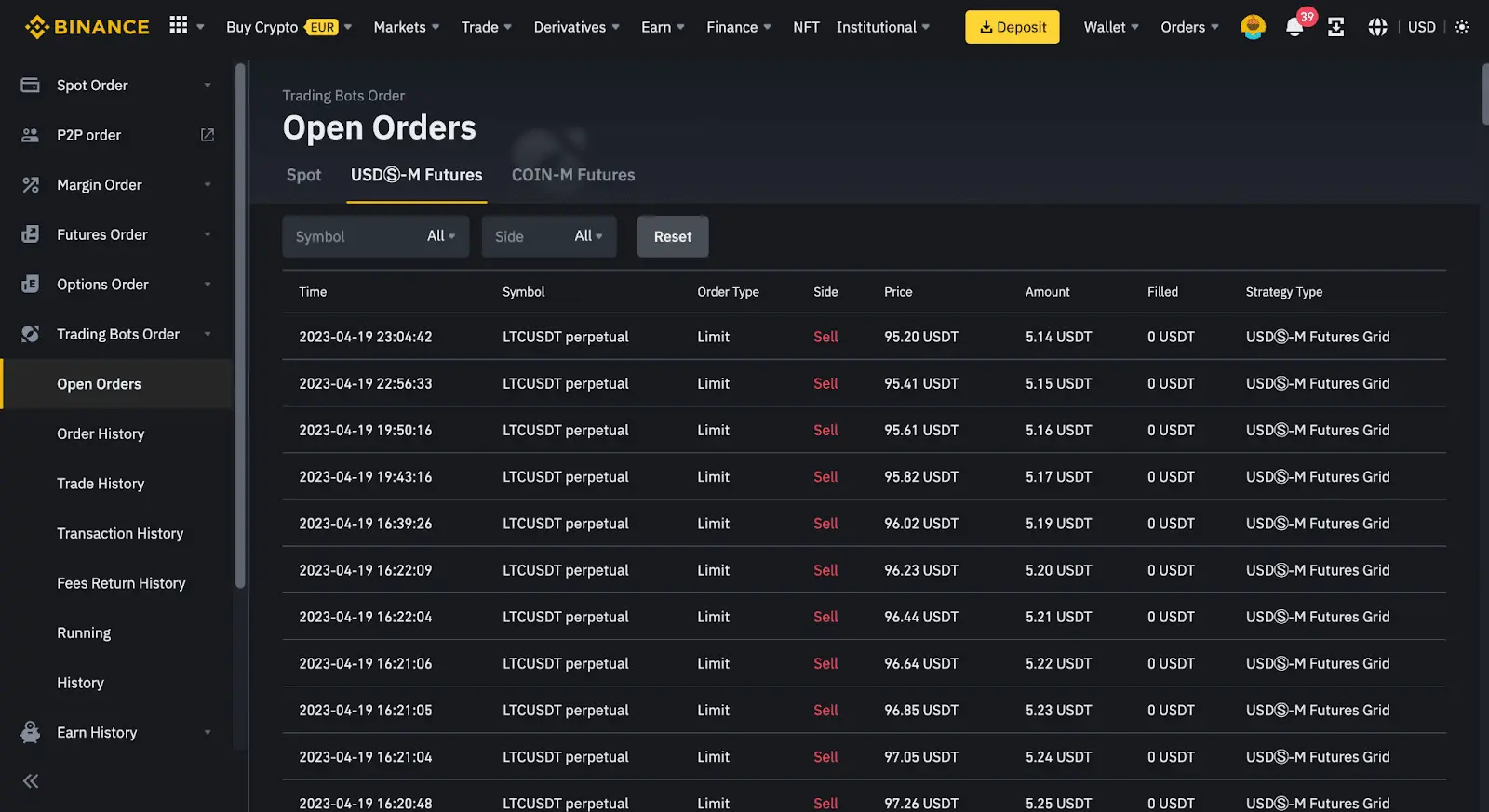

To get started log into your Aesir account and navigate to Create New Strategy. Scroll down to layer selection (after configuring the General options for your strategy) and select the Computed Indicators Layer.

From the Computed Indicators screen you can choose one or more indicators to be evaluated by Tradingview. The threshold refers to how many out of your selected indicators need to return a buy signal in order for your Binance TA bot to place a buy order.

Build a Binance TA Bot using the Technical Analysis Layer

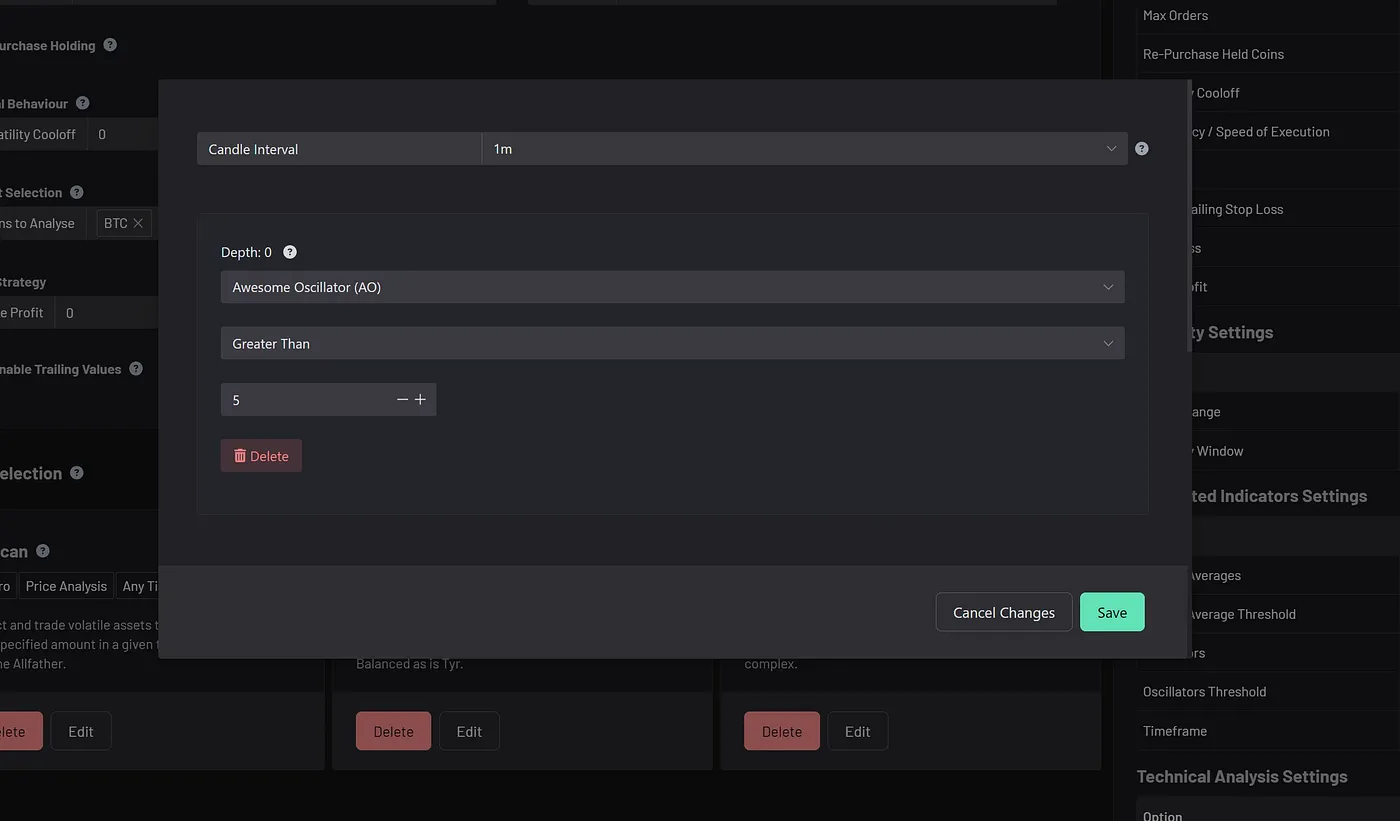

The technical analysis layer allows you near-unlimited, granular customization of your Binance TA bot, by allowing you to control exactly where and how a buy signal is returned and acted upon by your bot.

To get started, select the Candle Interval you want to operate on and then start building your logic. You can create a simple strategy with a single condition, for instance: Awesome Oscillator is greater than 5, by selecting add condition.

To create more complex strategies, add a logic tree instead. This is where it gets fun. Once you’ve created a logic tree, you can now add multiple conditions, or more logic trees, up to 4 levels deep. This allows you to create highly complex and unique logic, in order to gain an edge in the market.

Manage The Risk of your Binance TA Trading Bot

Effective risk management is a cornerstone of successful trading. Aesir incorporates several features to ensure traders manage their risk effectively.

The platform provides a Trailing Stop Loss option, an essential tool in the volatile crypto markets. This feature adjusts your stop loss level automatically as the price of your asset increases, securing your gains in case of a sudden market downturn.

The Max Open Orders feature lets you determine the maximum number of open orders at a time. By controlling the number of orders, you can manage your potential exposure effectively.

Finally, the Volatility Cool-off feature prevents hasty decision-making. If a coin is bought, it will ignore another buy signal on the same asset for a specified duration, helping you avoid buying into short-term price spikes.

Remember, the best way to learn is by doing. So why wait? Sign up to Æsir and Join Our Discord (it’s good stuff).