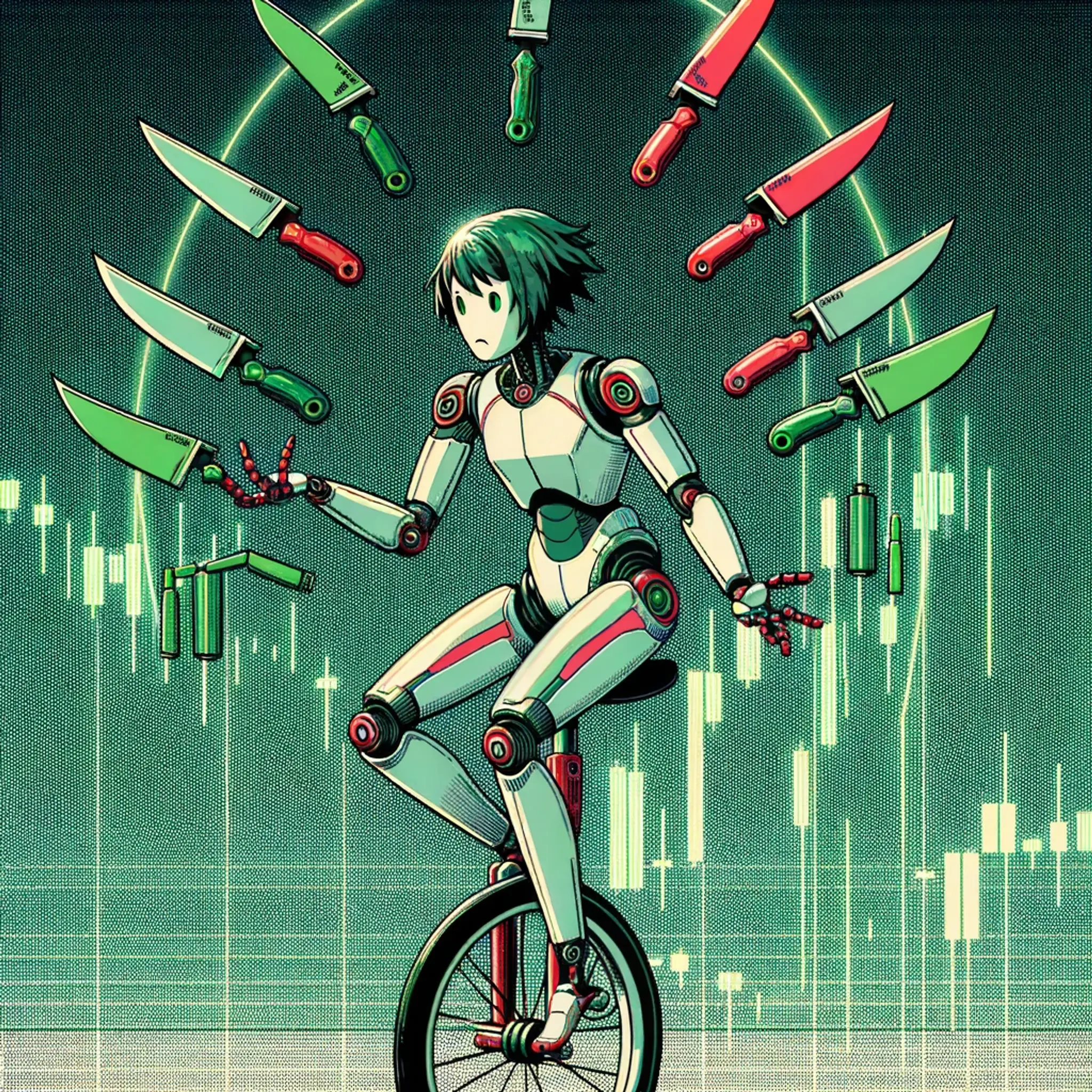

A Guide to Building Responsible Algo Crypto Trading Bots

Sun Nov 05 2023

Understanding how to leverage algorithmic cryptocurrency trading platforms such as Aesir is crucial for any trader looking to create responsible, well optimized and profitable trading bots.

There are many ways in which traders can leverage tools such as algorithmic cryptocurrency trading platforms in order to maximise their gains, or to spot brand new opportunities that may otherwise be impossible to detect, or action while trading manually.

Algorithmic trading platforms are designed to allow users to take their strategies to the next level quickly and easily. However, like with all tool, users must approach this responsibly, and take extra care when working with such tools. Here are some of the most important concepts to keep in mind when working with cryptocurrency trading bots.

Understanding Algorithmic Cryptocurrency Trading Platforms

The core of any successful cryptocurrency trading strategy lies in the reliability and sophistication of the algorithmic cryptocurrency trading platform you choose. A platform like Æsir serves as the cornerstone, providing the necessary tools and frameworks for your trading bot to operate in real-time market conditions. The right platform will offer you the security, testing capabilities, and analytical prowess needed for informed trading. Æsir is a robust platform that, if leveraged well can take your trading to the next level.

Crafting a Responsible Cryptocurrency Trading Bot

A responsible cryptocurrency trading bot is more than just a set of programmed instructions; it’s a reflection of a well-thought-out trading strategy that emphasizes risk management, security, and adaptability. Let’s delve into the critical aspects of constructing such a bot.

Secure Your Credentials

Most algorithmic cryptocurrency trading platform will require access to your preferred exchange in order to manage your portfolio on your behalf. You will need to generate an API Key and Secret with a certain permission set. Pay close attention to the permissions you give those keys, as the wrong permissions can make your account vulnerable to attack:

- Always Disable Withdrawals: Most algorithmic cryptocurrency trading platforms don’t require withdraw permissions in order to operate so do not enable this unless absolutely crucial.

- Never Re-use your API Key: On most exchanges, you can create multiple sets of API keys. For good housekeeping as well as to potentially enable you to limit damage in a potential exploit - each API key generated should only be used in 1 service.

- Don’t share your API key with anyone: Æsir support, or any customer support in general will never ask for your API key. If you’ve given your key and secret to someone you shouldn’t have, disable that key immediately from the API management screen on your preferred exchange.

Design a Structured Trading Plan

Before starting to trade, you need to formulate a trading plan. What are you looking to achieve? What strategies are you going to use? How will you be confirming your hypothesis?

Your bot’s strategy must be backed by a comprehensive trading plan. Here are the essentials for your plan:

- Trade Types: Define the specific trade setups your bot will engage in.

- Market Conditions: Set the parameters under which your bot will operate.

- Objectives and Limits: Outline your trading goals and risk thresholds.

By formulating these elements, you ensure your cryptocurrency trading bot has a clear path to follow.

Embrace Risk Management

Effective risk management is not optional; it’s a must. Incorporating stop loss orders within your bot’s algorithm ensures that your exposure to potential losses is mitigated, and your trading remains within the bounds of your risk tolerance.

Verbalize Your Strategy

A solid test of your algo trading strategy’s robustness is your ability to explain it clearly:

- Trade Mechanics: Outline how and when your bot will execute trades.

- Timeframes: Specify the expected duration for holding trades.

- Diversification: Decide on the number of assets your bot will handle daily.

Test and Optimize

Prior to live deployment, your strategy should undergo rigorous testing:

- Backtesting: Run your bot against historical data to gauge performance under past market conditions.

- Paper Trading: Deploy your bot in a simulated environment with live data but no real money at stake.

Both forms of testing are crucial for fine-tuning your bot’s strategy. Remember, you can paper trade for free on platforms like ÆsirCrypto.

Concluding Thoughts

Algorithmic trading offers a competitive edge but is not devoid of risks. Whether your preference lies in the hands-on approach or you lean towards the algorithmic sophistication of a cryptocurrency trading bot, the principles of responsible trading remain unchanged. Stay disciplined, adhere to best practices, and always prioritize risk management. Engage with the community, like those on discord, to exchange insights and experiences in algo trading. Remember, responsible trading is smart trading.