How to Configure the Kraken Volatility Trading Bot On Aesir

Wed Aug 09 2023

Volatility is one of the defining factors of Cryptocurrency markets. Aesir's Kraken Volatility Trading bot can help you maximize your gains by buying into volatile assets at just the right time.

Volatility is one of the defining factors of cryptocurrency markets. Because of their volatile nature, crypto markets can be very lucrative but equally high risk. Aesir’s Kraken Volatility Trading bot is a cryptocurrency bot that allows you to take advantage of cryptocurrency volatility by scanning every coin on the Kraken exchange.

When used well, this trading approach ensure that you do not miss out on the top gaining assets on the Kraken exchange.

Introducing Aesir’s Unique Kraken Volatility Trading Bot

Originally named the “Volatility Trading Bot”, Aesir’s Volscan Module allows you to trade the cryptocurrency market based on pure volatility. Unlike other signals or bots out there, the coinbase volatility trading bot allows for near limitless customization of the volatility threshold that your strategy will be based on. The best thing about it is that it can scan all assets on Coinbase in under a few seconds, making it one of the fastest trading tools on the market.

Configuring The Kraken Volatility Trading Bot On Aesir

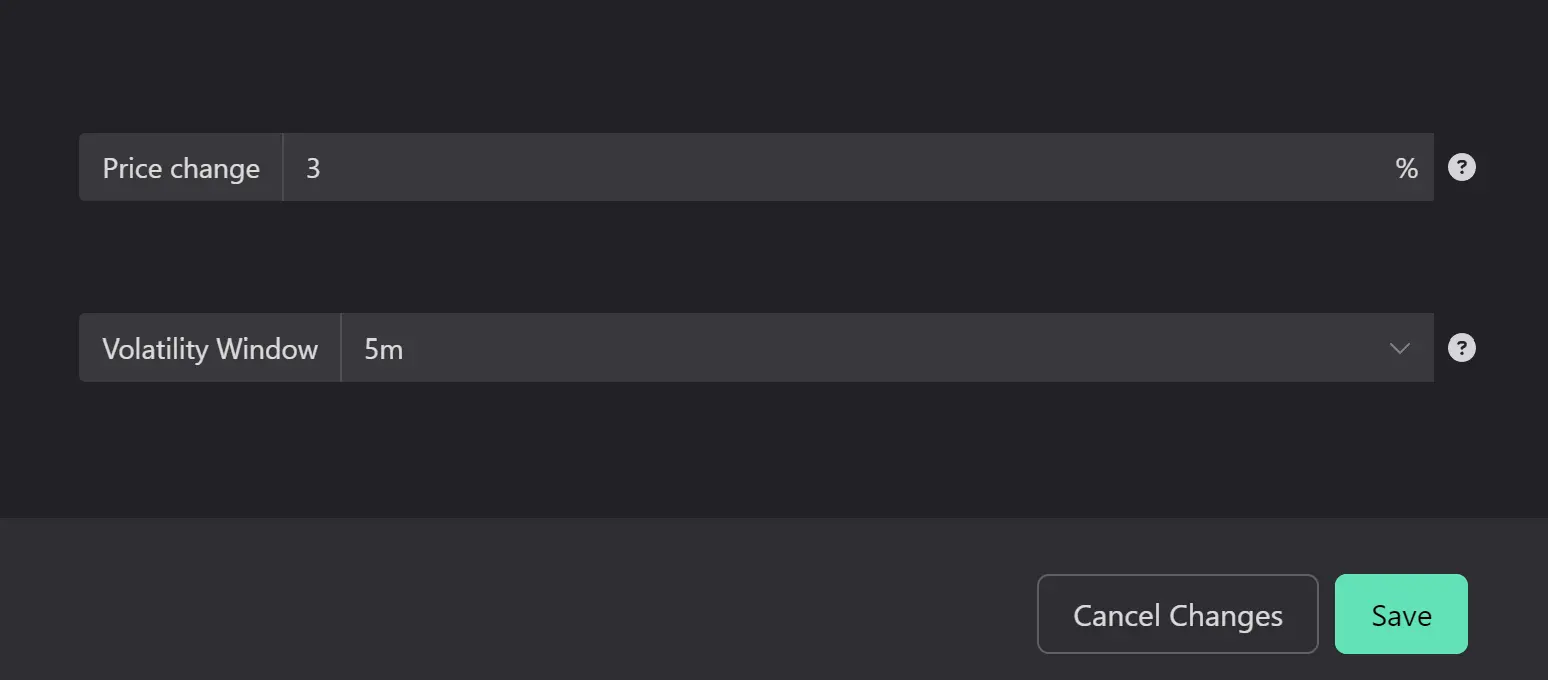

The Volscan module, previously known as the binance volatility bot before we extended it to support multiple exchanges, allows you to quickly and efficiently detect market volatility by using to key configurable options: Price Change and Volatility Window.

For instance, you could set your trading bot to purchase any coin on coinbase that has risen by more than 3% in the last five minutes – a short-term volatility strategy. However, both the Price Change % and Volatility window can be customized to suit any trading style you desire.

For example, you can create a logic similar to the one below:

BUY any coin on KRAKEN that gained more than 3% in the last 5 minutes.

with the Kraken volatility bot you can measure both short and long-term volatility. Like with every strategy, the success lies within thoroughly testing and measuring the profitability of your trading bot before setting it live on the market. On Aesir you can do that with our paper-trading mode.

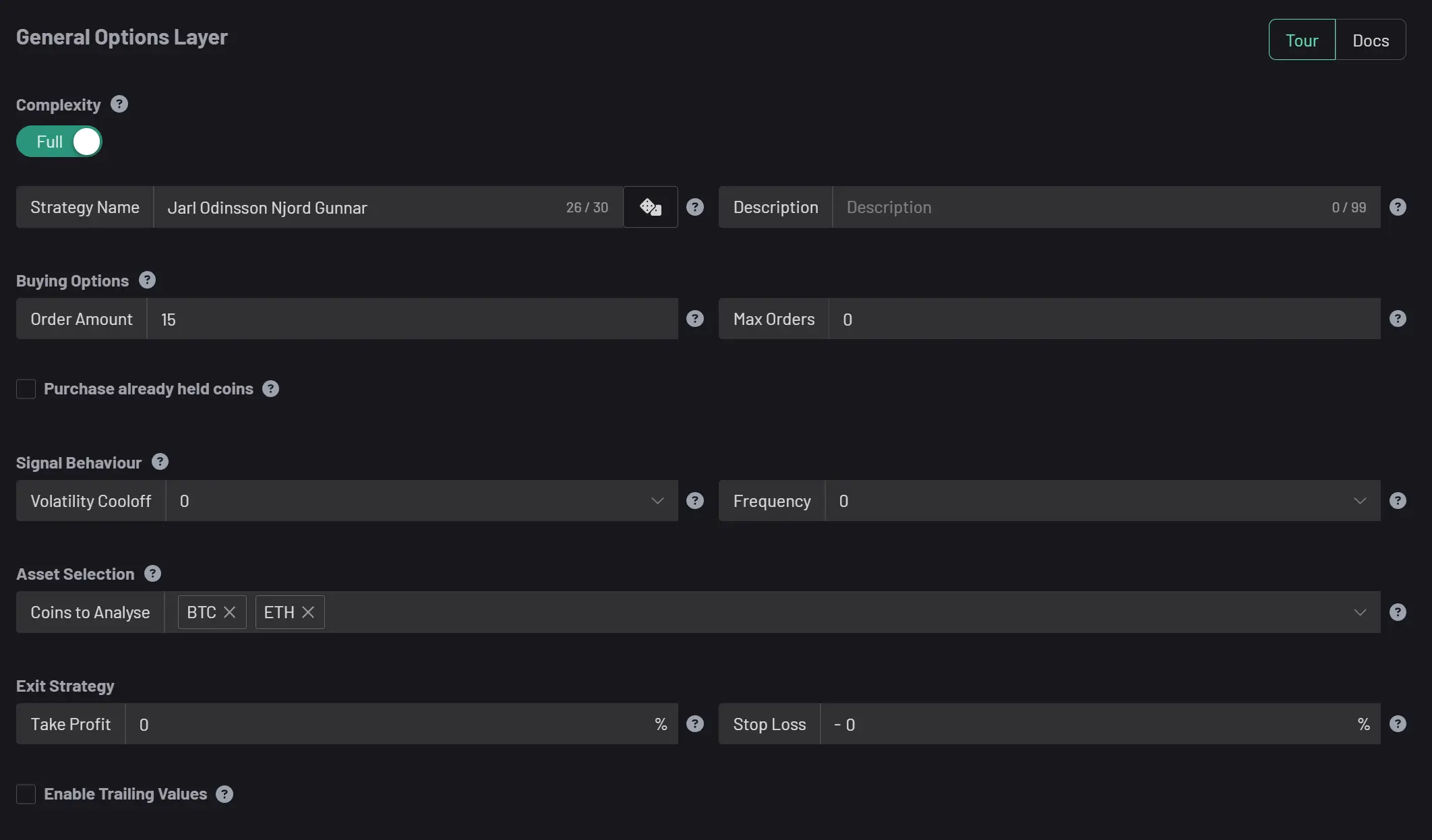

One of the key strengths of Aesir is its capacity to analyze all coins listed on Kraken. If you opt not to specify any coins in the “Coins To Analyze” field, the bot will measure every available coin on the platform. Alternatively, you have the flexibility to focus on specific coins, providing you with precise control over your trading strategy.

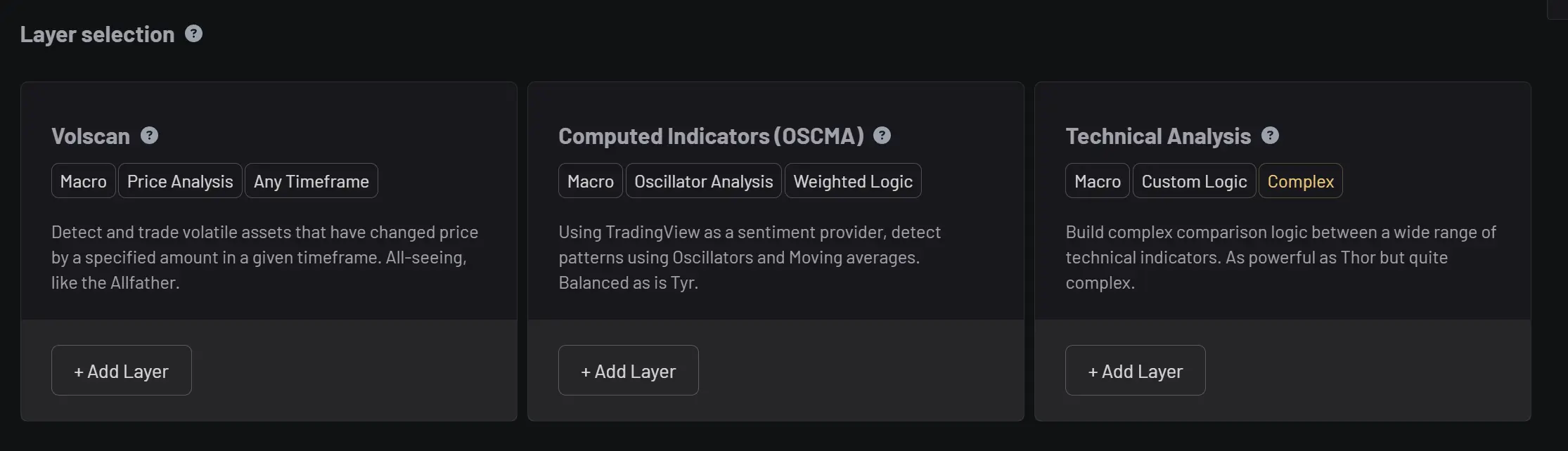

To get started with your Kraken volatility bot, simply create an account on Aesir, Navigate over to Create New Strategy and select the Volscan Layer.

On top of the Price Change and Volatility Windows logic of the Volscan module itself, you’ll also need to configure your strategy’s general options such as the Amount to spend per trade, the Maximum number of open orders, as well as your Volatility Cooloff and your exit strategy in the form of Take Profit and Stop Loss.

The volatility cooloff can be applied to any kind of strategy, but it’s particularly useful on the coinbase volatility trading bot. The cool-off tells the bot to ignore a buy signal for a certain period of time, if a previous buy signal was acted upon recently.

For instance, if your trading bot just placed a buy order on Bitcoin, you might want to exclude any other positive signals for the next minute, in order to reduce the potential of double buys.

Extending Your Kraken Volatility Bot

Aesir allows you to further customize your trading bots by configuring how you enter and exit the market and create really unique signals.

Adding one or more confirmation layers to your Volatility bot can ensure that your volatility signal is confirmed by other technical indicators. This can be good in order to exclude false positives and could lead to more accurate signals from your trading bot. You might not want to buy on Volatility alone, so you can choose any other kind of signal that will also need to be evaluated as true before your bot places a buy order. For instance you can add a Technical Analysis layer and chose to only buy when the volatility criteria is met plus your EMA5, EMA10 and EMA20 are under 70. You can choose any number of indicators.

Remember, the best way to learn is by doing. Sign up to Æsir to get started and Join Our Discord (it’s good stuff).